Will Falling Oil Prices Crash The Markets?

December 14, 2014 by Administrator · Leave a Comment

Shale Leads The Way…

Crude oil prices dipped lower on Wednesday pushing down yields on US Treasuries and sending stocks down sharply. The 30-year UST slipped to a Depression era 2.83 percent while all three major US indices plunged into the red. The Dow Jones Industrial Average (DJIA) led the retreat losing a hefty 268 points before the session ended. The proximate cause of Wednesday’s bloodbath was news that OPEC had reduced its estimate of how much oil it would need to produce in 2015 to meet weakening global demand. According to USA Today:

“OPEC lowered its projection for 2015 production to 28.9 million barrels a day, or about 300,000 fewer than previously forecast, and a 12-year low…. That’s about 1.15 million barrels a day less than the cartel pumped last month, when OPEC left unchanged its 30 million barrel daily production quota…

The steep decline in crude price raises fears that small exploration and production companies could go out of business if the prices fall too low. And that, in turn, could cause turmoil among those who are lending to them: Junk-bond purchasers and smaller banks.” (USA Today)

Lower oil prices do not necessarily boost consumption or strengthen growth. Quite the contrary. Weaker demand is a sign that deflationary pressures are building and stagnation is becoming more entrenched. Also, the 42 percent price-drop in benchmark U.S. crude since its peak in June, is pushing highly-leveraged energy companies closer to the brink. If these companies cannot roll over their debts, (due to the lower prices) then many will default which will negatively impact the broader market. Here’s a brief summary from analyst Wolf Richter:

“The price of oil has plunged …and junk bonds in the US energy sector are getting hammered, after a phenomenal boom that peaked this year. Energy companies sold $50 billion in junk bonds through October, 14% of all junk bonds issued! But junk-rated energy companies trying to raise new money to service old debt or to fund costly fracking or off-shore drilling operations are suddenly hitting resistance.

And the erstwhile booming leveraged loans, the ugly sisters of junk bonds, are causing the Fed to have conniptions. Even Fed Chair Yellen singled them out because they involve banks and represent risks to the financial system. Regulators are investigating them and are trying to curtail them through “macroprudential” means, such as cracking down on banks, rather than through monetary means, such as raising rates. And what the Fed has been worrying about is already happening in the energy sector: leveraged loans are getting mauled. And it’s just the beginning…

“If oil can stabilize, the scope for contagion is limited,” Edward Marrinan, macro credit strategist at RBS Securities, told Bloomberg. “But if we see a further fall in prices, there will have to be a reaction in the broader market as problems will spill out and more segments of the high-yield space will feel the pain.”…Unless a miracle happens that will goose the price of oil pronto, there will be defaults, and they will reverberate beyond the oil patch.” (Oil and Gas Bloodbath Spreads to Junk Bonds, Leveraged Loans. Defaults Next, Wolf Ricter, Wolf Street)

The Fed’s low rates and QE pushed down yields on corporate debt as investors gorged on junk thinking the Fed “had their back”. That made it easier for fly-by-night energy companies to borrow tons of money at historic low rates even though their business model might have been pretty shaky. Now that oil is cratering, investors are getting skittish which has pushed up rates making it harder for companies to refinance their debtload. That means a number of these companies going to go bust, which will create losses for the investors and pension funds that bought their debt in the form of financially-engineered products. The question is, is there enough of this financially-engineered gunk piled up on bank balance sheets to start the dominoes tumbling through the system like they did in 2008?

That question was partially answered on Wednesday following OPEC’s dismal forecast which roiled stocks and send yields on risk-free US Treasuries into a nosedive. Investors ditched their stocks in a mad dash for the exits thinking that the worst is yet to come. USTs provide a haven for nervous investors looking for a safe place to hunker down while the storm passes.

Economist Jack Rasmus has an excellent piece at Counterpunch which explains why investors are so jittery. Here’s a clip from his article titled “The Economic Consequences of Global Oil Deflation”:

“Oil deflation may lead to widespread bankruptcies and defaults for various non-financial companies, which will in turn precipitate financial instability events in banks tied to those companies. The collapse of financial assets associated with oil could also have a further ‘chain effect’ on other forms of financial assets, thus spreading the financial instability to other credit markets.” (The Economic Consequences of Global Oil Deflation, Jack Rasmus, CounterPunch)

Falling oil prices typically drag other commodities prices down with them. This, in turn, hurts emerging markets that depend heavily on the sale of raw materials. Already these fragile economies are showing signs of stress from rising inflation and capital flight. In a country like Japan, however, one might think the effect would be positive since the lower yen has made imported oil more expensive. But that’s not the case. Falling oil prices increase deflationary pressures forcing the Bank of Japan to implement more extreme measures to reverse the trend and try to stimulate growth. What new and destabilizing policy will Japan’s Central Bank employ in its effort to dig its way out of recession? And the same question can be asked of Europe too, which has already endured three bouts of recession in the last five years. Here’s Rasmus again on oil deflation and global financial instability:

“Oil is not only a physical commodity bought, sold and traded on global markets; it has also become an important financial asset since the USA and the world began liberalized trading of oil commodity futures…

Just as declines in oil spills over to declines of other physical commodities…price deflation can also ‘spill over’ to other financial assets, causing their decline as well, in a ‘chain like’ effect.

That chain like effect is not dissimilar to what happened with the housing crash in 2006-08. At that time the deep contraction in the global housing sector ( a physical asset) not only ‘spilled over’ to other sectors of the real economy, but to mortgage bonds…and derivatives based upon those bonds, also crashed. The effect was to ‘spill over’ to other forms of financial assets that set off a chain reaction of financial asset deflation.

The same ‘financial asset chain effect’ could arise if oil prices continued to decline below USD$60 a barrel. That would represent a nearly 50 percent deflation in oil prices that could potentially set in motion a more generalized global financial instability event, possibly associated with a collapse of the corporate junk bond market in the USA that has fueled much of USA shale production.” (CounterPunch)

This is precisely the scenario we think will unfold in the months ahead. What Rasmus is talking about is “contagion”, the lethal spill-over from one asset class to another due to deteriorating conditions in the financial markets and too much leverage. When debts can no longer be serviced, defaults follow sucking liquidity from the system which leads to a sudden (and excruciating) repricing event. Rasmus believes that a sharp cutback in Shale gas and oil production could ignite a crash in junk bonds that will pave the way for more bank closures. Here’s what he says:

“The shake out in Shale that is coming will not occur smoothly. It will mean widespread business defaults in the sector. And since much of the drilling has been financed with risky high yield corporate ‘junk’ bonds, the shale shake out could translate into a financial crash of the US corporate junk bond market, which is now very over-extended, leading to regional bank busts in turn.” (CP)

The financial markets are a big bubble just waiting to burst. If Shale doesn’t do the trick, then something else will. It’s just a matter of time.

Rasmus also believes that the current oil-glut is politically motivated. Washington’s powerbrokers persuaded the Saudis to flood the market with petroleum to push down prices and crush oil-dependent Moscow. The US wants a weak and divided Russia that will comply with US plans to increase its military bases in Central Asia and allow NATO to be deployed to its western borders. Here’s Rasmus again:

“Saudi Arabia and its neocon friends in the USA are targeting both Iran and Russia with their new policy of driving down the price of oil. The impact of oil deflation is already severely affecting the Russian and Iranian economies. In other words, this policy of promoting global oil price deflation finds favor with significant political interests in the USA, who want to generate a deeper disruption of Russian and Iranian economies for reasons of global political objectives. It will not be the first time that oil is used as a global political weapon, nor the last.” (CP)

Washington’s strategy is seriously risky. There’s a good chance the plan could backfire and send stocks into freefall wiping out trillions in a flash. Then all the Fed’s work would amount to nothing.

Karma’s a bitch.

Mike Whitney is a regular columnist for Veracity Voice

Mike Whitney lives in Washington state. He can be reached at:

Subprime Loans And Auto Sales: Debt On Wheels

November 8, 2014 by Administrator · Leave a Comment

“It’s not the underlying economics that’s driving things, it’s central bank liquidity.”

— Matt King, Citigroup

Soaring auto sales are not so much a sign of a strong economy as they are an indication of financial hanky-panky. We saw this same type of fakery play out in housing between 2004 – 2006, when prices went through the roof due to a mortgage-lending scam (“subprime”) that crashed the stock market and sent the economy reeling. Now the bigtime money guys are at it again, writing up auto loans for anyone who can sit upright in a chair and scribble an “X” on the dotted line. As a result, car sales have surged to over 16 million for the last 6 months. (A full 7 million more than the low point in January, 2009.) And it’s not hard to see why either. The finance gurus are packaging these sketchy subprimes into bonds, offloading them on eager investors, and recycling the profits into more crappy loans. It’s a perfect circle and it won’t end until the loans start blowing up, jittery investors head for the exits, and Uncle Sugar rides to the rescue with more bailouts.

But we’re getting ahead of ourselves. First take a look at these charts by House of Debt which shows the disparity between auto spending and other types of spending since the end of the slump in 2009.

House of Debt: “New auto purchases have driven the consumer spending recovery to a large degree. The chart below shows the spending recovery for new auto sales and for all other retail spending…

From 2009 to 2013, spending on new autos increased by 40% in nominal terms. All other spending increased by only 20%. Further, excluding autos, 2013 saw lower growth in nominal retail spending than 2012…

The concern is that a lot of auto purchases are being fueled with debt, given a strong recovery in the auto loan market. Below is the net flow of auto loans from 2002 to 2013. It is a net flow because it includes pay downs in addition to new originations. As it shows, auto lending in 2012 and 2013 tops any other year during the previous expansion from 2002 to 2007 (although it is still below the amount of new auto loans in 2000 and 2001).

How about that? So there’s a bigger debt bubble in auto loans today than there was before the bust. But why? Is it because demand is strong, jobs are plentiful, wages are rising, the economy is growing, and people are optimistic about the future?

Heck, no. It’s because rates are low, credit is easy, and dealers are ready to put anyone with a license and a heartbeat into a brand-spanking new car no questions asked. Here are the details from an article in the New York Times titled “In a Subprime Bubble for Used Cars, Borrowers Pay Sky-High Rates” by Jessica Silver-Greenberg and Michael Corkery:

”Auto loans to people with tarnished credit have risen more than 130 percent in the five years since the immediate aftermath of the financial crisis, with roughly one in four new auto loans last year going to borrowers considered subprime — people with credit scores at or below 640.

The explosive growth is being driven by some of the same dynamics that were at work in subprime mortgages. A wave of money is pouring into subprime autos, as the high rates and steady profits of the loans attract investors. Just as Wall Street stoked the boom in mortgages, some of the nation’s biggest banks and private equity firms are feeding the growth in subprime auto loans by investing in lenders and making money available for loans.

And, like subprime mortgages before the financial crisis, many subprime auto loans are bundled into complex bonds and sold as securities by banks to insurance companies, mutual funds and public pension funds — a process that creates ever-greater demand for loans.

The New York Times examined more than 100 bankruptcy court cases, dozens of civil lawsuits against lenders and hundreds of loan documents and found that subprime auto loans can come with interest rates that can exceed 23 percent. The loans were typically at least twice the size of the value of the used cars purchased, including dozens of battered vehicles with mechanical defects hidden from borrowers. Such loans can thrust already vulnerable borrowers further into debt, even propelling some into bankruptcy, according to the court records, as well as interviews with borrowers and lawyers in 19 states.

In another echo of the mortgage boom, The Times investigation also found dozens of loans that included incorrect information about borrowers’ income and employment, leading people who had lost their jobs, were in bankruptcy or were living on Social Security to qualify for loans that they could never afford.” (“In a Subprime Bubble for Used Cars, Borrowers Pay Sky-High Rates”, New York Times)

Can you believe that this kind of chicanery is going on in broad daylight without the regulators stepping in? Think about it for a minute: If the NYT’s journalists can find “dozens of loans that included incorrect information about borrowers’ income and employment”, then why can’t the government regulators? It’s ridiculous. What we’re talking about here is a new version of “liar’s loans” where dealers are helping people who don’t have the means to repay the debt, to fudge the details on their loan application so they can drive off in a shiny new Impala.

Haven’t we seen this movie before?

Here’s more from USA Today: “In the first quarter of 2014, 24.9% of all new-car loans were 73 to 84 months long. Four years ago, less than 10% of loans were that long. In fact, such lengthy terms have pulled the average new-car loan to 66 months. That’s an all-time record.”

7 years to pay off a car? You got to be kidding me? It’s like a second mortgage. And there’s more, too. The average monthly payment and average amount financed hit record highs in the first quarter too. This is from Auto News:

“The average monthly new-vehicle payment was $474 in the first quarter, up 3.3 percent from a year ago. The average monthly used-vehicle payment was $352, up 1.1 percent, Experian Automotive said.

Also in the first quarter, the average amount financed on a new-vehicle loan was $27,612, an increase of $964, or 3.6 percent. For used vehicles, the average amount financed was $17,927, up $395 or 2.3 percent.”

(“Auto loan terms, monthly payments hit high in Q1, Experian says“, Auto News)

So Americans are not just loading on more debt, they’re also assuming that they’re financial situation is going to be stable enough to make these large payments well into the future. Good luck with that.

It’s also worth noting that, in many transactions, dealers are actually lending more than the value of the vehicle. According to Reuters David Henry,

“The average loan-to-value on new cars rose to 110.6 percent… On used cars it rose to 133.2 percent…

Auto lenders often provide loans that exceed the value of cars they are financing because borrowers want cash to pay sales taxes and fees.”

(“U.S. car buyers borrow more as rates fall and standards loosen“, David Henry, Reuters)

Let me see if I got this straight: You walk onto a car lot without a dime in your pocket, and drive off in a brand new car with everything paid for upfront? Such a deal! Can you see why we think that the sales numbers are a big fake? This isn’t the sign of a strong economy. It’s the sign of another gigantic credit bubble rip-off. But what do the dealers get out of this thing? Is it really worth their while to botch the underwriting when they know that eventually they’ll have to repossess the vehicle? Sure, it is, because there’s big money in stuffing people into loans they can’t afford.

Here’s how the Times explains it: ”Auto loans to borrowers considered subprime, those with credit scores at or below 640, have spiked in the last five years. The jump has been driven in large part by the demand among investors for securities backed by the loans, which offer high returns at a time of low interest rates. Roughly 25 percent of all new auto loans made last year were subprime, and the volume of subprime auto loans reached more than $145 billion in the first three months of this year.”

Bingo. So not only do they make dough on the high interest rates they charge their subprime borrowers, (Sometimes 23 percent or more.) they also make it by selling the loan to investors who are eager to buy any manner of crappy bond provided it offers a better return than US Treasuries. This is the mess Bernanke created by fixing interest rates at zero for nearly 6 years. Zirp (zero interest rate policy) unavoidably leads to excessive risk taking by yield-crazed speculators. The voracious appetite for subprime securities (ABS–Asset-Backed Securities) has even surprised the bond issuers who are constantly beating the bushes looking for sketchier products. This is from the same article by the NY Times:

“Investors, seeking a higher return when interest rates are low, recently flocked to buy a bond issue from Prestige Financial Services of Utah. Orders to invest in the $390 million debt deal were four times greater than the amount of available securities.

What is backing many of these securities? Auto loans made to people who have been in bankruptcy.

An affiliate of the Larry H. Miller Group of Companies, Prestige specializes in making the loans to people in bankruptcy, packaging them into securities and then selling them to investors.

“It’s been a hot space,” Richard L. Hyde, the firm’s chief operating officer, said during an interview in March. Investors are betting on risky borrowers. The average interest rate on loans bundled into Prestige’s latest offering, for example, is 18.6 percent, up slightly from a similar offering rolled out a year earlier…. To meet that rising demand, Wall Street snatches up more and more loans to package into the complex investments.” (NYT)

HA! Now there’s a good way to feather the old retirement fund; load up on bonds made up of loans to people who’ve gone bust.

This is the impact that zero rates have on investor behavior. The abundance of cheap and plentiful liquidity invariably leads to trouble. And there are victims in this Central Bank-authored gold rush too, namely the unsophisticated borrowers who pay prohibitively high rates on beater vehicles that are typically worth less-than-half the value of the loan. (Check the NYT article for examples.)

The Times also notes that the ratings agencies have been playing along with the finance companies just as they did during the subprime mortgage fiasco. Here’s more from the Times:

“Rating agencies, which assess the quality of the bonds, are helping fuel the boom. They are giving many of these securities top ratings, which clears the way for major investors, from pension funds to employee retirement accounts, to buy the bonds. In March, for example, Standard & Poor’s blessed most of Prestige’s bond with a triple-A rating. Slices of a similar bond that Prestige sold last year also fetched the highest rating from S.&P. A large slice of that bond is held in mutual funds managed by BlackRock, one of the world’s largest money managers.” (NYT)

Ask yourself this, dear reader: How are the ratings agencies able to give “many of these securities top ratings”, when the investigators from the Times found “dozens of loans that included incorrect information about borrowers’ income and employment, leading people who had lost their jobs, were in bankruptcy or were living on Social Security to qualify for loans that they could never afford”?

Let’s face it: The regulatory changes in Dodd-Frank haven’t done a damn thing to protect the victims of these dodgy subprime schemes. Borrowers and investors are both getting gouged by a system that only protects the interests of the perpetrators. The sad fact is that nothing has changed. The system is just as corrupt as it was when Lehman went down.

So, how long can this go on before the market implodes?

According to the Times:

“financial firms are beginning to see signs of strain. In the first three months of this year, banks had to write off as entirely uncollectable an average of $8,541 of each delinquent auto loan, up about 15 percent from a year earlier, according to Experian…

In another sign of trouble ahead, repossessions, while still relatively low, increased nearly 78 percent to an estimated 388,000 cars in the first three months of the year from the same period a year earlier, according to the latest data provided by Experian. The number of borrowers who are more than 60 days late on their car payments also jumped in 22 states during that period….” (NYT)

(According to Amber Nelson at loan.com: “In the second quarter, the value of all auto loans late by 60 days or more was more than $4 billion, up 27 percent from the prior year, according to Experian.”)

So, yeah, the trouble is mounting, but that doesn’t mean that this madness won’t continue for some time to come. It probably will. It’ll probably drag-on until the economy turns south and more borrowers start falling behind on their payments. That will lead to more defaults, heavier losses on auto bonds, and a hasty race to the exits by investors. Isn’t that how the subprime mortgage scam played out?

Indeed. But at least there are signs of hope on the regulatory front. Check out this clip from an article at CNBC:

“In August, both Santander Consumer and General Motors Financial Co. acknowledged receiving Justice Department subpoenas in connection with a probe over possible violations of civil-fraud laws. And the Consumer Financial Protection Bureau and the Securities and Exchange Commission have both stepped up their scrutiny of the auto-loan market.” (“New debt crisis fear: Subprime auto loans“, CNBC)

So the SEC, the DOJ, and the CFPB are actually investigating the underwriting practices of these behemoth finance companies to see if they violated “civil fraud laws”?

Will wonders never cease?

Just don’t hold your breath waiting for convictions.

Mike Whitney is a regular columnist for Veracity Voice

Mike Whitney lives in Washington state. He can be reached at:

The American Dream, Gone

November 8, 2014 by Administrator · Leave a Comment

15 Reasons Why Americans Think We’re Still in a Recession…

1: Wage Stagnation: Why America’s Workers Need Faster Wage Growth—And What We Can Do About It, Elise Gould, EPI

Economic Policy Institute:

“The hourly compensation of a typical worker grew in tandem with productivity from 1948-1973. …. After 1973, productivity grew strongly, especially after 1995, while the typical worker’s compensation was relatively stagnant. This divergence of pay and productivity has meant that many workers were not benefitting from productivity growth—the economy could afford higher pay but it was not providing it.

Between 1979 and 2013, productivity grew 64.9 percent, while hourly compensation of production and nonsupervisory workers, who comprise over 80 percent of the private-sector workforce, grew just 8.0 percent. Productivity thus grew eight times faster than typical worker compensation…” (EPI)

(Note: Flatlining wages are the Number 1 reason that the majority of Americans still think we’re in a recession.)

2: Most people still haven’t recouped what they lost in the crash: Typical Household Wealth Has Plunged 36% Since 2003, Zero Hedge

Zero Hedge:

“According to a new study by the Russell Sage Foundation, the inflation-adjusted net worth for the typical household was $87,992 in 2003. Ten years later, it was only $56,335, or a 36% decline… Welcome to America’s Lost Decade.

Simply put, the NY Times notes, it’s not merely an issue of the rich getting richer. The typical American household has been getting poorer, too.

The reasons for these declines are complex and controversial, but one point seems clear: When only a few people are winning and more than half the population is losing, surely something is amiss. (chart)”

3: Most working people are still living hand-to-mouth: 76% of Americans are living paycheck-to-paycheck, CNN Money

CNN:

“Roughly three-quarters of Americans are living paycheck-to-paycheck, with little to no emergency savings, according to a survey released by Bankrate.com Monday.

Fewer than one in four Americans have enough money in their savings account to cover at least six months of expenses, enough to help cushion the blow of a job loss, medical emergency or some other unexpected event, according to the survey of 1,000 adults. Meanwhile, 50% of those surveyed have less than a three-month cushion and 27% had no savings at all…

Last week, online lender CashNetUSA said 22% of the 1,000 people it recently surveyed had less than $100 in savings to cover an emergency, while 46% had less than $800. After paying debts and taking care of housing, car and child care-related expenses, the respondents said there just isn’t enough money left over for saving more.”

4: Millennials are Drowning in Red Ink: Biggest economic threat? Student loan debt, USA Today

USA Today:

“Total student loan debt has grown more than 150% since 2005… We have more than $1.2 trillion of student loan debt…

And while 6.7 million borrowers in repayment mode are delinquent, the sad fact is that many lenders aren’t exactly incentivized to work with borrowers. Unlike all other forms of debt, student loans can’t be discharged in bankruptcy. Moreover, lenders can garnish wages and even Social Security benefits to get repaid…In 2005 student loans accounted for less than 13% of the total debt load for adults age 20-29. Today, student loans account for nearly 37% of that group’s outstanding debt. Student loan debt’s slice of the total debt pie for the age group nearly tripled! The average loan balance for that age group is now more than $25,500, up from $15,900 in 2005.”

5: Downward mobility is the new reality: Middle-Class Death Watch: As Poverty Spreads, 28 Percent of Americans Fall Out of Middle Class, Truthout

Truthout:

“The promise of the American dream has given many hope that they themselves could one day rise up the economic ladder. But according to a study released those already in financially-stable circumstances should fear falling down a few rungs too. The study… found that nearly a third of Americans who were part of the middle class as teenagers in the 1970s have fallen out of it as adults… its findings suggest the relative ease with which people in the U.S. can end up in low-income, low-opportunity lifestyles — even if they started out with a number of advantages. Though the American middle class has been repeatedly invoked as a key factor in any economic turnaround, numerous reports have suggested that the middle class enjoys less existential security than it did a generation ago, thanks to stagnating incomes and the decline of the industrial sector.”

6: People are more vulnerable than ever: “More Than Half Of All Americans Can’t Come Up With $400 In Emergency Cash… Unless They Borrow“, Personal Liberty

“According to a Federal Reserve report on American households’ “economic well-being” in 2013, fewer than half of all Americans said they’d be able to come up with four Benjamins on short notice to deal with an unexpected expense…

Under a section titled “Savings,” the report notes that “[s]avings are depleted for many households after the recession,” and lists the following findings:*Among those who had savings prior to 2008, 57 percent reported using up some or all of their savings in the Great Recession and its aftermath.

*39 percent of respondents reported having a rainy day fund adequate to cover three months of expenses.

*Only 48 percent of respondents said that they would completely cover a hypothetical emergency expense costing $400 without selling something or borrowing money.

7: Working people are getting poorer: The Typical Household, Now Worth a Third, New York Times

NYT:

“The inflation-adjusted net worth for the typical household was $87,992 in 2003. Ten years later, it was only $56,335, or a 36 percent decline, according to a study financed by the Russell Sage Foundation.

Those are the figures for a household at the median point in the wealth distribution — the level at which there are an equal number of households whose worth is higher and lower. But during the same period, the net worth of wealthy households increased substantially….“The housing bubble basically hid a trend of declining financial wealth at the median that began in 2001,” said Fabian T. Pfeffer, the University of Michigan professor who is lead author of the Russell Sage Foundation study.

The reasons for these declines are complex and controversial, but one point seems clear: When only a few people are winning and more than half the population is losing, surely something is amiss.”

8: Most people can’t even afford to get their teeth fixed: 7 things the middle class can’t afford anymore, USA Today

USA Today:

“A vacation is an extra expense that many middle-earners cannot afford without sacrificing something else. A Statista survey found that this year 54% of people gave up purchasing big ticket items like TVs or electronics so they can go on a vacation. Others made sacrifices like reducing or eliminating their trips to the movies (47%), reducing or eliminating trips out to restaurants (43%), or avoiding purchasing small ticket items like new clothing (43%).

2–New vehicles…

3–To pay off debt…

4–Emergency savings…

5–Retirement savings…

6–Medical care…

7–Dental work…According to the U.S. Department of Health and Human Services, “the U.S. spends about $64 billion each year on oral health care — just 4% is paid by Government programs.” About 108 million people in the U.S. have no dental coverage and even those who are covered may have trouble getting the care they need, the department reports.”

9: The good, high-paying jobs have vanished: Recovery Has Created Far More Low-Wage Jobs Than Better-Paid Ones, New York Times

NYT:

“The deep recession wiped out primarily high-wage and middle-wage jobs. Yet the strongest employment growth during the sluggish recovery has been in low-wage work, at places like strip malls and fast-food restaurants.

In essence, the poor economy has replaced good jobs with bad ones. That is the conclusion of anew report from the National Employment Law Project, a research and advocacy group, analyzing employment trends four years into the recovery.

“Fast food is driving the bulk of the job growth at the low end — the job gains there are absolutely phenomenal,” said Michael Evangelist, the report’s author. “If this is the reality — if these jobs are here to stay and are going to be making up a considerable part of the economy — the question is, how do we make them better?”

10: More workers are throwing in the towel: Labor Participation Rate Drops To 36 Year Low; Record 92.6 Million Americans Not In Labor Force, Zero Hedge

Zero Hedge:

“For those curious why the US unemployment rate just slid once more to a meager 5.9%, the lowest print since the summer of 2008, the answer is the same one we have shown every month since 2010: the collapse in the labor force participation rate, which in September slid from an already three decade low 62.8% to 62.7% – the lowest in over 36 years, matching the February 1978 lows. And while according to the Household Survey, 232,000 people found jobs, what is more disturbing is that the people not in the labor force, rose to a new record high, increasing by 315,000 to 92.6 million!

Bottom line: Unemployment has gone down because more people aren’t working and have fallen off the radar.”

11: Nearly twice as many people still rely on Food Stamps than before the recession: Food-stamp use is falling from its peak, Marketwatch

Marketwatch:

“Food-stamp use is finally moving away from the peak. At 46.1 million people, total food-stamp usage is down about 4% from its high in December 2012 of 47.8 million. Only eight states in March (the latest data available) were up from the same month of 2013.

It’s still not great news, however, considering there were 26.3 million people receiving food stamps in 2007…”

12: The ocean of red ink continues to grow: American Household Credit Card Debt Statistics: 2014, Nerd Wallet Finance

Nerd Wallet Finance:

U.S. household consumer debt profile:

*Average credit card debt: $15,607

*Average mortgage debt: $153,500

*Average student loan debt: $32,656

In total, American consumers owe:

*$11.63 trillion in debt

*An increase of 3.8% from last year

*$880.5 billion in credit card debt

*$8.07 trillion in mortgages

*$1,120.3 billion in student loans

*An increase of 11.5% from last year

13: No Recovery for working people: The collapse of household income in the US, World Socialist Web Site

WSWS:

“The US Federal Reserve’s latest Survey of Consumer Finances, released last Thursday, documents a devastating decline in economic conditions for a large majority of the population during the so-called economic recovery.

The report reveals that between 2007 and 2013, the income of a typical US household fell 12 percent. The median American household now earns $6,400 less per year than it did in 2007.

Source: Federal Reserve Survey of Consumer Finances

Much of the decline occurred during the “recovery” presided over by the Obama administration. In the three years between 2010 and 2013, the annual income of a typical household fell by an additional 5 percent.

The report also shows that wealth has become even more concentrated in the topmost economic layers. The wealth share of the top 3 percent climbed from 44.8 percent in 1989 to 54.4 percent in 2013. The share of wealth held by the bottom 90 percent fell from 33.2 percent in 1989 to 24.7 percent in 2013.”

14: Most people will work until they die: The Greatest Retirement Crisis In American History, Forbes

Forbes:

“We are on the precipice of the greatest retirement crisis in the history of the world. In the decades to come, we will witness millions of elderly Americans, the Baby Boomers and others, slipping into poverty.

Too frail to work, too poor to retire will become the “new normal” for many elderly Americans.

That dire prediction… is already coming true. Our national demographics, coupled with indisputable glaringly insufficient retirement savings and human physiology, suggest that a catastrophic outcome for at least a significant percentage of our elderly population is inevitable. With the average 401(k) balance for 65 year olds estimated at $25,000 by independent experts …the decades many elders will spend in forced or elected “retirement” will be grim…

The signs of the coming retirement crisis are all around you. Who’s bagging your groceries: a young high school kid or an older “retiree” who had to go back to work to supplement his income or qualify for health insurance?”

15: Americans are more pessimistic about the future, Polling Report

According to a CNN/ORC Poll May 29-June 1, 2014:

“Do you agree or disagree? The American dream has become impossible for most people to achieve.”

Agree: 59%

Disagree: 40%

Unsure: 1%

According to a NBC News/Wall Street Journal Poll conducted by the polling organizations of Peter Hart (D) and Bill McInturff (R). April 23-27, 2014:

“Do you agree or disagree with the following statement? Because of the widening gap between the incomes of the wealthy and everyone else, America is no longer a country where everyone, regardless of their background, has an opportunity to get ahead and move up to a better standard of living.”Agree: 54%

Disagree: 43%

Mixed: 2%

Unsure: 1%

Also, according to a CBS News Poll. Jan. 17-21, 2014. N=1,018 adults nationwide.

“Looking to the future, do you think most children in this country will grow up to be better off or worse off than their parents?”Better off: 34%

Worse off: 63%

Same: 2%

Unsure: 1%

The majority of people in the United States, no longer believe in the American dream, or that America is the land of opportunity, or that their children will have a better standard of living than their own. They’ve grown more pessimistic because they haven’t seen the changes they were hoping for, and because their lives are just as hard as they were right after the crash. In fact, according to a 2014 Public Religion Research Institute poll– 72 percent of those surveyed said they think “the economy is still in recession.”

Judging by the info in the 15 links above, they’re probably right.

Mike Whitney is a regular columnist for Veracity Voice

Mike Whitney lives in Washington state. He can be reached at:

“There You Go Again”

November 2, 2014 by Administrator · 1 Comment

Reince Priebus, the chairman of the Republican National Committee (RNC), was on a conference call this past Monday evening, which was sponsored by TheTeaParty.net and attended by hundreds of Tea Party activists. During the conference call, a Tea Party activist asked him about President Barack Obama’s plans for executive amnesty. Priebus replied, “It’s unconstitutional, illegal, and we don’t support it.”

Breitbart.com covered the story. “‘While I can’t speak for the legislature, I’m very confident we will stop that,’ Priebus said. ‘We will do everything we can to make sure it doesn’t happen: Defunding, going to court, injunction. You name it. It’s wrong. It’s illegal. And for so many reasons, and just the basic fabric of this country, we can’t allow it to happen and we won’t let it happen. I don’t know how to be any stronger than that. I’m telling you, everything we can do to stop it we will.’”

Breitbart goes on to quote Priebus, “‘I have said repeatedly on immigration that the first thing is border security and the second thing is upholding the law that’s in place today. What ever happened to the border fence that was promised by Congress in 2006? It never happened. What about these sanctuary cities out there that take federal money and they’re not even upholding the law that we have in place? So somehow or another what can’t get lost in any of this conversation is the importance of border security and making sure that any sort of immigration reform talk doesn’t even begin without taking that first step.’”

As Ronald Reagan said to President Jimmy Carter, “There you go again.” There the GOP goes again: making a promise they have absolutely no intention of keeping.

Priebus’ promise that, should the GOP capture the U.S. Senate, they will stop Obama’s executive amnesty is just so much hot air. I guess he thinks that we have all forgotten then Speaker of The House Newt Gingrich’s “Contract With America.”

During the congressional elections of 1994, Gingrich promised the American people that if they put Republicans in charge of the Congress, they would pass legislation to eliminate five federal departments (Education, Energy, Commerce, Interior, and Housing and Urban Development), 95 federal domestic programs, and slash federal spending across the board. The GOP promises made during the ’94 elections became known as the “Contract With America.”

GOP promises during that election cycle proved extremely successful. In the House of Representatives there was a 54-seat swing to the Republicans, which gave them a majority of seats for the first time since 1954. In the U.S. Senate there was an eight-seat swing, which allowed the GOP to capture both houses of Congress.

During the succeeding congressional session, many of the elements of the Contract were indeed passed by the Republican-led House of Representatives. It was quite another story in the GOP-led Senate. In the Senate, most of the promised bills were either killed altogether or seriously compromised through a variety of watered-down amendments. A few bills–and I mean a precious few bills–made it somewhat intact out of the Senate. At the end of the session, very little of the Contract survived. In fact, during that time, Republican senators reminded everyone that the Contract With America was only the promise of the GOP House, that the GOP Senate never joined in that promise. (Politicians are the slickest liars in the world, are they not?)

While there were several positive results of that “Republican Revolution” of 1994, including a balanced budget in 1998 and surpluses in the federal budgets from 1999-2001–all of these budgets being proposed by Democratic President Bill Clinton–Gingrich and Senate Majority Leader Trent Lott quickly began to compromise away most of the principles of the 1994 Contract. This led to Gingrich being ousted as Speaker of the House.

Of course, none of the five federal departments targeted were eliminated–neither were any of the 95 targeted federal programs. In fact, not only were these departments and programs not eliminated, funding for all of these departments and programs actually INCREASED under the GOP-led Congress. In 2000, Edward Crane, president of the Cato Institute, noted that “the combined budgets of the 95 major programs that the Contract With America promised to eliminate have increased by 13%.” And, in case Republicans want to try and blame the Democrat Bill Clinton for these budgetary backslidings, the facts just don’t support it.

Consider the fact that from 2001 through 2006, the GOP controlled the entire federal government: the White House, House of Representatives, and Senate. Plus, Republican-appointed justices comprised a majority on the U.S. Supreme Court. (That has been the case since the early 1970s). During those long six years, the GOP-dominated federal government NEVER revisited the principles of the Contract With America. In fact, the Bush years are on record as seeing the most explosive growth in federal spending and overreach in U.S. history to that time. There has been absolutely NOTHING fiscally conservative about the Twenty-First Century GOP. And that’s a fact.

Again, even though the GOP controlled the entire federal government for the first six years of this century, there was no attention given to the promises of the 1994 Contract With America. In addition, no attention was given to overturning Roe v. Wade and ending legalized abortion-on-demand, and no attention was given to overturning Bill Clinton’s egregiously unconstitutional Executive Orders. In fact, no attention was given to G.W. Bush’s campaign promises of fiscal restraint and no-nation building, non-aggressive foreign policy promises, or his vow to honor the Constitution by curbing the usurpations of Washington, D.C., of individual liberties and civil rights. What a joke that turned out to be!

Now we have a Democratic President, Barack Obama, who is one of the most unpopular presidents of our entire history, and the GOP is struggling to energize its own base. How pathetic is that? That’s why RNC Chairman Reince Priebus took to the air with a live conference call with Tea Party activists. The national GOP has so alienated Tea Party conservatives that it is concerned that even with a despised Democrat President, disenfranchised conservatives within the GOP could stay home in large numbers next Tuesday.

Priebus’ concern is warranted.

So, Priebus makes a Contract With America-type promise: give us the Senate and we will stop Obama’s executive amnesty. And even though it was a conference call, I assume he said it with a straight face. The problem is, it is a lie, and Priebus knows it.

Obama is going to sign his executive amnesty order soon after the elections and before the Senate convenes next year. And there are about as many Republicans in the Senate that favor amnesty as there are Democrats. Does anyone really think that John McCain, Lindsey Graham, Lamar Alexander, et al. are going to get exercised over amnesty? The Chamber of Commerce establishment Republicans are salivating over amnesty for illegals. Some of them are trying to hide an amnesty amendment in the upcoming NDAA even as we speak. Plus, just exactly what is the Senate going to do to overturn an executive amnesty order? I can already hear it. After the GOP wins the Senate, they will say, “Well, as the U.S. Senate, we can’t really do anything; we need a Republican President in 2016. Then we will do something about it.” And the beat goes on.

It’s not about stopping amnesty; it’s about political posturing for a November election. House Speaker John Boehner has promised Big Business Republicans an amnesty deal. Does anyone in their right mind believe the GOP is going to overturn an Obama amnesty order? It’s a campaign bluff. I know it; and so does Barack Obama. (I would love to be proven wrong; but the GOP track record says I am 100% right.)

The Breitbart report goes on to say, “Priebus said at the end of the town hall that he thinks it’s important for Tea Partiers and the grassroots to hold Republicans accountable.

“‘I think it’s important to build our party through addition and make sure that we don’t subtract people out of our party,’ he said. ‘It’s also important for the Tea Party to hold the Republican Party accountable. I get that. It’s not always a cheerleading opportunity. It’s both that we’re going to be with you and help you, but we have to hold you accountable once in a while. And I understand that and respect it.’”

See the report here:

No, Priebus doesn’t understand that; neither does he respect it. This is pure partisan party electioneering.

The GOP leadership has not allowed itself to be held accountable to ANYBODY. They wouldn’t let Ross Perot do it; they wouldn’t let Pat Buchanan do it; they wouldn’t let Ron Paul do it; and they aren’t letting the Tea Party Republicans do it. They think themselves above their own platform, above their conservative base, and even above the U.S. Constitution. Accordingly, they have been subtracting numbers from their own ranks for a long, long time. Where do you think the Libertarian and Constitution parties came from? Where do you think so many of the registered independent voters came from?

In any given national election the numbers of people who stay home and don’t vote always outnumber the ones who do vote. Why is that? It’s because both the Democrat and Republican parties have been ignoring so much of their grassroots base that people from both parties have been drifting away by the millions. People by the millions have given up on both major parties. Neither party in Washington, D.C., respects the people of the United States or the U.S. Constitution. Both parties grovel before Big Money. That’s why so many people have removed themselves from the two major parties.

If the Republican leadership in Washington, D.C., had been listening to its base over the past several years, Barack Obama would not be President today and the GOP would not be biting its fingernails as to whether they can take back the Senate. This should be a slam-dunk election for the GOP. And, despite the stiff-necked, Big Business, Big Brother leadership of the national Republican Party, I think the GOP will take the Senate. But if you think for one minute that a GOP-led Senate and House will do diddly squat to stop Obama’s amnesty order or to close our Southern Border, there is this bridge in the Mojave Desert you need to look at. The GOP is famous for doing NOTHING after elections are won.

Reince Priebus lamented over the failure of Congress to honor its promise to close the Southern Border back in 2006. Well, Mr. Priebus, it was the Republican Party that controlled the federal government from 2001-2006, and despite their promises to close the Southern Border, did NOTHING to actually do it. And you think a GOP-led Congress is going to do something about it now? What a joke! Most of the anti-amnesty Republicans are in the House, and they are not even a majority within their own caucus there. Try to name the anti-amnesty senators. The only ones I can recall who have been outspoken against amnesty are Jeff Sessions, Ted Cruz, and Mike Lee. Even Rand Paul has softened on the subject.

I wasn’t on the Tea Party conference call last Monday evening with Mr. Priebus when he said what he said, but I’m hoping someone on the call hollered, “There you go again.”

Chuck Baldwin is a regular columnist for Veracity Voice

You can reach him at:

Please visit Chuck’s web site at: http://www.chuckbaldwinlive.com

Risky Business “Easy Money”

November 1, 2014 by Administrator · Leave a Comment

Here we go again.

Last week, the country’s biggest mortgage lenders scored a couple of key victories that will allow them to ease lending standards, crank out more toxic assets, and inflate another housing bubble. Here’s what’s going on.

On Monday, the head of the Federal Housing Finance Agency (FHFA), Mel Watt, announced that Fannie and Freddie would slash the minimum down-payment requirement on mortgages from 5 percent to 3 percent while making loans more available to people with spotty credit. If this all sounds hauntingly familiar, it should. It was less than 7 years ago that shoddy lending practices blew up the financial system precipitating the deepest slump since the Great Depression. Now Watt wants to repeat that catastrophe by pumping up another credit bubble. Here’s the story from the Washington Post:

“When it comes to taking out a mortgage, two factors can stand in the way: the price of the mortgage,…and the borrower’s credit profile.”

On Monday, the head of the agency that oversees the mortgage giants Fannie Mae and Freddie Mac outlined … how he plans to make it easier for borrowers on both fronts. Mel Watt, director of the Federal Housing Finance Agency, did not give exact timing on the initiatives. But most of them are designed to encourage the industry to extend mortgages to a broader swath of borrowers.

Here’s what Watt said about his plans in a speech at the Mortgage Bankers Association annual convention in Las Vegas:

Saving enough money for a downpayment is often cited as the toughest hurdle for first-time buyers in particular. Watt said that Fannie and Freddie are working to develop “sensible and responsible” guidelines that will allow them to buy mortgages with down payments as low as 3 percent, instead of the 5 percent minimum that both institutions currently require.”

Does Watt really want to “encourage the industry to extend mortgages to a broader swath of borrowers” or is this just another scam to enrich bankers at the expense of the public? It might be worth noting at this point that Watt’s political history casts doubt on his real objectives. According to Open Secrets, among the Top 20 contributors to Watt’s 2009-2010 campaign were Goldman Sachs, Bank of America, Citigroup Inc., Bank of New York Mellon, American bankers Association, US Bancorp, and The National Association of Realtors. (“Top 20 Contributors, 2009-2010“, Open Secrets)

Man oh man, this guy’s got all of Wall Street rooting for him. Why is that, I wonder? Is it because he’s faithfully executing his office and defending the public’s interests or is it because he’s a reliable stooge who brings home the bacon for fatcat bankers and their brood?

This is such a farce, isn’t it? I mean, c’mon, do you really think that the big banks make political contributions out of the kindness of their heart or because they want something in return? And do you really think that a guy who is supported by Goldman Sachs has your “best interests” in mind? Don’t make me laugh.

The reason that Obama picked Watt was because he knew he could be trusted to do whatever Wall Street wanted, and that’s precisely what he’s doing. Smaller down payments and looser underwriting are just the beginning; teaser rates, balloon payments, and liars loans are bound to follow. In fact, there’s a funny story about credit scores in the Washington Post that explains what’s really going on behind the scenes. See if you can figure it out:

“Most housing advocates agree that a bigger bang for the buck would come from having lenders lower the unusually high credit scores that they’re now demanding from borrowers.

After the housing market tanked, Fannie and Freddie forced the industry to buy back billions of dollars in loans. In a bid to protect themselves from further financial penalties, lenders reacted by imposing credit scores that exceed what Fannie and Freddie require. Housing experts say the push to hold lenders accountable for loose lending practices of the past steered the industry toward the highest-quality borrowers, undermining the mission of Fannie and Freddie to serve the broader population, including low- to moderate- income borrowers.

Today, the average credit score on a loan backed by Fannie and Freddie is close to 745, versus about 710 in the early 2000s, according to Moody’s Analytics. And lenders say they won’t ease up until the government clarifies rules that dictate when Fannie and Freddie can take action against them.” (Washington Post)

Can you see what’s going on? The banks have been requiring higher credit scores than Fannie or Freddie.

But why? After all, the banks are in the lending business, so the more loans they issue the more money they make, right?

Right. But the banks don’t care about the short-term dough. They’d rather withhold credit and slow the economy in order to blackmail the government into doing what they want.

And what do they want?

They want looser regulations and they want to know that Fannie and Freddie aren’t going to demand their money back (“put backs”) when they sell them crappy mortgages that won’t get repaid. You see, the banks figure that once they’ve off-loaded a loan to Fannie and Freddie, their job is done. So, if the mortgage blows up two months later, they don’t think they should have to pay for it. They want the taxpayer to pay for it. That’s what they’ve been whining about for the last 5 years. And that’s what Watt is trying to fix for them. Here’s the story from Dave Dayen:

“Watt signaled to mortgage bankers that they can loosen their underwriting standards, and that Fannie and Freddie will purchase the loans anyway, without much recourse if they turn sour. The lending industry welcomed the announcement as a way to ease uncertainty and boost home purchases, a key indicator for the economy. But it’s actually a surrender to the incorrect idea that expanding risky lending can create economic growth.

Watt’s remarks come amid a concerted effort by the mortgage industry to roll back regulations meant to prevent the type of housing market that nearly obliterated the economy in 2008. Bankers have complained to the media that the oppressive hand of government prevents them from lending to anyone with less-than-perfect credit. Average borrower credit scores are historically high, and lenders make even eligible borrowers jump through enough hoops to garner publicity. Why, even Ben Bernanke can’t get a refinance done! (Actually, he could, and fairly easily, but the anecdote serves the industry’s argument.)

(“The Mortgage Industry Is Strangling the Housing Market and Blaming the Government“, Dave Dayen, The New Republic)

Can you see what a fraud this is? 6 years have passed since Lehman crashed and the scum-sucking bankers are still fighting tooth-and-nail to unwind the meager provisions that have been put in place to avoid another system-shattering disaster. It’s crazy. These guys should all be in Gitmo pounding rocks and instead they’re setting the regulatory agenda. Explain that to me? And this whole thing about blackmailing the government because they don’t want to be held responsible for the bad mortgages they sold to the GSE’s is particularly irritating. Here’s more from Dave Dayen:

“After the housing market tanked, Fannie and Freddie forced the industry to buy back billions of dollars in loans. In a bid to protect themselves from further financial penalties, lenders reacted by imposing credit scores that exceed what Fannie and Freddie require. ….And lenders say they won’t ease up until the government clarifies rules that dictate when Fannie and Freddie can take action against them.”

So the industry has engaged in an insidious tactic: tightening lending well beyond required standards, and then claiming the GSEs make it impossible for them to do business. For example, Fannie and Freddie require a minimum 680 credit score to purchase most loans, but lenders are setting their targets at 740. They are rejecting eligible borrowers….so they can profit much more from a regulation-free zone down the line.

So, I ask you, dear reader; is that blackmail or is it blackmail?

And what does Watt mean when he talks about “developing sensible and responsible guidelines’ that will allow them (borrowers) to buy mortgages with down payments as low as 3 percent”?

What a joke. Using traditional underwriting standards, (the likes of which had been used for the entire post-war period until we handed the system over to the banks) a lender would require a 10 or 20 percent down, decent credit scores, and a job. The only reason Watt wants to wave those requirements is so the banks can fire-up the old credit engine and dump more crap-ass mortgages on Uncle Sam. That’s the whole thing in a nutshell. It’s infuriating!

Let me fill you in on a little secret: Down payments matter! In fact, people who put more down on a home (who have “more skin in the game”) are much less likely to default. According to David Battany, executive vice president of PennyMac, “there is a strong correlation between down payments to mortgage default. The risk of default almost doubles with every 1%.”

Economist Dean Baker says the same thing in a recent blog post:

“The delinquency rate, which closely follows the default rate, is several times higher for people who put 5 percent or less down on a house than for people who put 20 percent or more down.

Contrary to what some folks seem to believe, getting moderate income people into a home that they subsequently lose to foreclosure or a distressed sale is not an effective way for them to build wealth, even if it does help build the wealth of the banks.”

(“Low Down Payment Mortgages Have Much Higher Default Rates“, Dean Baker, CEPR)

Now take a look at this chart from Dr. Housing Bubble which helps to illustrate the dangers of low down payments in terms of increased delinquencies:

Data on mortgage delinquencies by downpayment. Source: Felix Salmon

“When the mortgage industry starts complaining about the 14 million people who would be denied the chance to buy a qualified mortgage if they don’t have a 5% downpayment, it’s worth remembering that qualified mortgages for people who don’t have a 5% downpayment have a delinquency rate of 16% over the course of the whole housing cycle.” (“Why a sizable down payment is important“, Dr. Housing Bubble)

So despite what Watt thinks, higher down payments mean fewer defaults, fewer foreclosures, fewer shocks to the market, and greater financial stability.

And here’s something else that Watt should mull over: The housing market isn’t broken and doesn’t need to be fixed. It’s doing just fine, thank you very much. First of all, sales and prices are already above their historic trend. Check it out from economist Dean Baker:

“If we compare total sales (new and existing homes) with sales in the pre-bubble years 1993-1995, they would actually be somewhat higher today, even after adjusting for population growth. While there may be an issue of many people being unable to qualify for mortgages because of their credit history, this does not appear to be having a negative effect on the state of market. Prices are already about 20 percent above their trend levels.” (“Total Home Sales Are At or Above Trend“, Dean Baker, CEPR)

Got it? Sales and prices are ALREADY where they should be, so there’s no need to lower down payments and ease credit to start another orgy of speculation. We don’t need that.

Second, the quality of today’s mortgages ARE BETTER THAN EVER, so why mess with success? Take a look at this from Black Knight Financial Services and you’ll see what I mean:

“Today, the Data and Analytics division of Black Knight Financial Services … released its November Mortgage Monitor Report, which found that loans originated in 2013 are proving to be the best-performing mortgages on record…..

“Looking at the most current mortgage origination data, several points become clear,” said Herb Blecher, senior vice president of Black Knight Financial Services’ Data & Analytics division. “First is that heightened credit standards have resulted in this year being the best-performing vintage on record. Even adjusting for some of these changes, such as credit scores and loan-to-values, we are seeing total delinquencies for 2013 loans at extremely low levels across every product category.”

Okay, so sales and prices are fine and mortgage quality is excellent. So why not leave the bloody system alone? As the saying goes: If it ain’t broke, don’t fix it.

But you know why they’re going to keep tinkering with the housing market. Everyone knows why. It’s because the banks can’t inflate another big-honking credit bubble unless they churn out zillions of shi**y mortgages that they offload onto Fannie and Freddie. That’s just the name of the game: Grind out the product (mortgages), pack it into sausages (securities and bonds), leverage up to your eyeballs (borrow as much as humanly possible), and dump the junk-paper on yield-chasing baboons who think they’re buying triple A “risk free” bonds.

Garbage in, garbage out. Isn’t this how the banks make their money?

You bet it is, and in that regard things have gotten a helluva a lot scarier since last Wednesday’s announcement that the banks are NOT going to be required to hold any capital against the securities they create from bundles of mortgages.

Huh?

You read that right. According to the New York Times: “there will be no risk retention to speak of, at least on residential mortgage loans that are securitized.”

But how can that be, after all, it wasn’t subprime mortgages that blew up the financial system (subprime mortgages only totaled $1.5 at their peak), but the nearly $10 trillion in subprime infected mortgage-backed securities (MBS) that stopped trading in the secondary market after a French Bank stopped taking redemptions in July 2007. (a full year before the crisis brought down Lehman Brothers) . That’s what brought the whole rattling financial system to a grinding halt. Clearly, if the banks had had a stake in those shabby MBS— that is, if they were required to set aside 5 or 10 percent capital as insurance in the event that some of these toxic assets went south– then the whole financial collapse could have been avoided, right?

Right. It could have been avoided. But the banks don’t want to hold any capital against their stockpile of rancid assets, in fact, they don’t want to use their own freaking money at all, which is why 90 percent of all mortgages are financed by Uncle Sugar. It’s because the banks are just as broke as they were in 2008 when the system went off the cliff. Here’s a summary from the New York Times:

“Once upon a time, those who made loans would profit only if the loan were paid back. If the borrower defaulted, the lender would suffer.

That idea must have seemed quaint in 2005, as the mortgage lending boom reached a peak on the back of mushrooming private securitizations of mortgages, which were intended to transfer the risk away from those who made the loans to investors with no real knowledge of what was going on.

Less well remembered is that there was a raft of real estate securitizations once before, in the 1920s. The securities were not as complicated, but they had the same goal — making it possible for lenders to profit without risking capital.

The Dodd-Frank Act of 2010 set out to clean that up. Now, there would be “risk retention.” Lenders would have to have “skin in the game.” Not 100 percent of the risk, as in the old days when banks made mortgage loans and retained them until they were paid back, but enough to make the banks care whether the loans were repaid.

At least that was the idea. The details were left to regulators, and it took more than four years for them to settle on the details, which they did this week.

The result is that there will be no risk retention to speak of, at least on residential mortgage loans that are securitized.

“…..Under Dodd-Frank, the general rule was to be that if a lender wanted to securitize mortgages, that lender had to keep at least 5 percent of the risk…….But when the final rule was adopted this week, that idea was dropped.” (“Banks Again Avoid Having Any Skin in the Game”, New York Times)

No skin in the game, you say?

That means the taxpayer is accepting 100 percent of the risk. How fair is that?

Let’s review: The banks used to lend money to creditworthy borrowers and keep the loans on their books.

They don’t do that anymore, in fact, they’re not really banks at all, they’re just intermediaries who sell their loans to the USG or investors.

This arrangement has changed the incentives structure. Now the goal is quantity not quality. “How many loans can I churn-out and dump on Uncle Sam or mutual funds etc.” That’s how bankers think now. That’s the objective.

Regulations are bad because regulations stipulate that loans must be of a certain quality, which reduces the volume of loans and shrinks profits. (Can’t have that!) Therefore, the banks must use their money to hand-pick their own regulators (“You’re doin’ a heckuva job, Mel”) and ferociously lobby against any rules that limit their ability to issue credit to anyone who can fog a mirror. Now you understand how modern-day banking works.

It would be hard to imagine a more corrupt system.

Mike Whitney is a regular columnist for Veracity Voice

Mike Whitney lives in Washington state. He can be reached at:

Our Population Growth Totalitarian Future

August 2, 2014 by Administrator · Leave a Comment

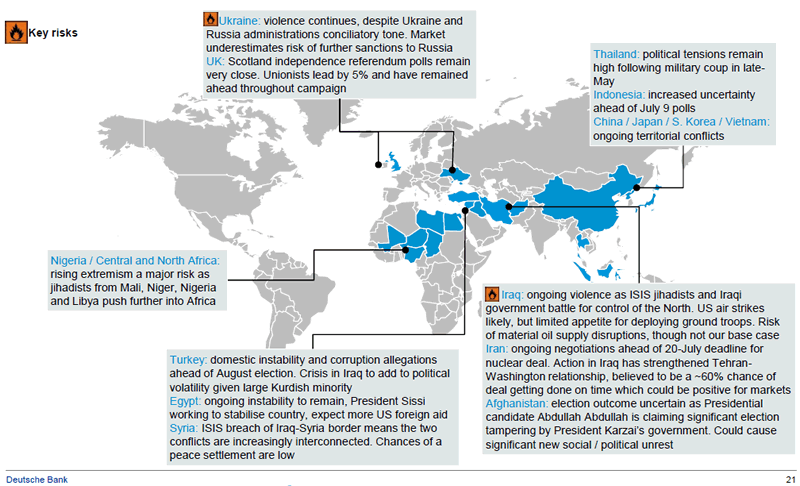

As the world explodes in violence, war, riots, and uprisings, it is challenging to step back and examine the bigger picture. With airliners being shot down over the Ukraine, missiles flying between Israel and Gaza, ongoing civil war in Syria, Iraq falling apart as ISIS gains ground, dictatorship crackdown in Egypt, Turkey on the verge of revolution, Iran gaining control of Iraq, Saudi Arabia fomenting violence, Africa dissolving into chaos, South America imploding and sending their children across our purposely porous southern border, Mexico under the control of drug lords, China experiencing a slow motion real estate collapse, Japan experiencing their third decade of Keynesian failure, facing a demographic nightmare scenario while being slowly poisoned by radiation, and Chinese-Japanese relations moving towards World War II levels, it is easy to get lost in the day to day minutia of history in the making.

Why is this happening at this point in history? Why is the average American economically worse off today than they were at the height of the economic crisis in 2009? Why is the Cold War returning with a vengeance? Why is the Federal Reserve still employing emergency monetary policies when we are supposedly five years into a recovery and the stock market has attained record highs? Why do the ECB and European politicians continue to paper over the insolvency of their banks and governments? Why did the U.S. support the ouster of a dictator we supported for decades in Egypt and then support the elevation of a new dictator after we didn’t like the policies of the democratically elected president? Why did the U.S. eliminate the leader of Libya and allow the country to descend into anarchy and civil war? Why did the U.S. fund and provoke a revolutionary overthrow of a democratically elected leader in the Ukraine? Why did the U.S. fund and arm Al Qaeda associated rebels in Syria who are now fighting our supposed allies in Iraq? Why has the U.S. been occupying Afghanistan for the last thirteen years with the result being a Taliban that is stronger than ever? Why are the BRIC countries forming a monetary union to challenge USD domination? Why is the U.S. attempting to provoke Russia into a conflict with NATO?

Why is the U.S. government collecting every electronic communication made by every American? Why is the U.S. government spying on world leader allies? Why is the U.S. government providing military equipment to local police forces? Why is the U.S. military conducting training exercises within U.S. cities? Why is the U.S. government attempting to restrict Second Amendment rights? Why is the U.S. government attempting to control and lockdown the internet? Why has the U.S. government chosen to treat the Fourth Amendment as if it is obsolete? Why is the national debt still rising by $750 billion per year ($2 billion per day) if the economy is back to normal? Why have 12 million working age Americans left the workforce since the economic recovery began? How could the unemployment rate be back at 2008 levels when there are 14 million more working age Americans and the same number employed as in 2008? Why are there 13 million more people on food stamps today than there were at the start of the economic recovery in 2009? Why have home prices risen by 25% since 2012 when mortgage applications have been at fourteen year lows? Why are Wall Street profits and bonuses at record highs while the real median household income stagnates at 1998 levels?

Why do 98% of incumbent politicians get re-elected when congressional approval levels are lower than whale shit? Why are oil prices four times higher than they were in 2003 if the U.S. is supposedly on the verge of energy independence? Why do the corporate controlled mainstream media choose to entertain and regurgitate government propaganda rather than inform, investigate and seek the truth? Why do corporations and shadowy billionaires control the politicians, media, judges, and financial system in their ravenous quest for more riches? Why has the public allowed a privately owned bank to control our currency and inflate away 96% of its value in 100 years? Why have American parents allowed their children to be programmed and dumbed down by government run public schools? Why have Americans allowed themselves to be lured into debt in an effort to appear wealthy and successful? Why have Americans permitted their brains to atrophy through massive doses of social media, reality TV, iGadget addiction, and a cultural environment of techno-narcissism? Why have Americans lost their desire to read, think critically, question authority, act responsibly, defer gratification, and care about future generations? Why have Americans sacrificed their freedoms, liberties and rights for the false expectation of safety and security? Why will we pay dearly for our delusional, materialistic, debt financed idiocy? – Because we never learn the lessons of history.

There are so many questions and no truthful answers forthcoming from those who pass for leaders in this increasingly totalitarian world. Our willful ignorance, apathy, hubris and arrogance will have consequences. Just because it hasn’t happened yet, doesn’t mean it’s not going to happen. The cyclicality of history guarantees a further deepening of this Crisis. The world has evolved from totalitarian hegemony to republican liberty and regressed back to totalitarianism throughout the centuries. Anyone honestly assessing the current state of the world and our country would unequivocally conclude we have regressed back towards a totalitarian regime where a small cabal of powerful oligarchs believes they can control and manipulate the masses in their gluttonous desire for treasure. Aldous Huxley foretold all the indicators of a world descending into totalitarianism due to overpopulation, propaganda, brainwashing, consumerism, and dumbing down of a distracted populace in his 1958 reassessment of his 1931 novel Brave New World.

Is There a Limit?

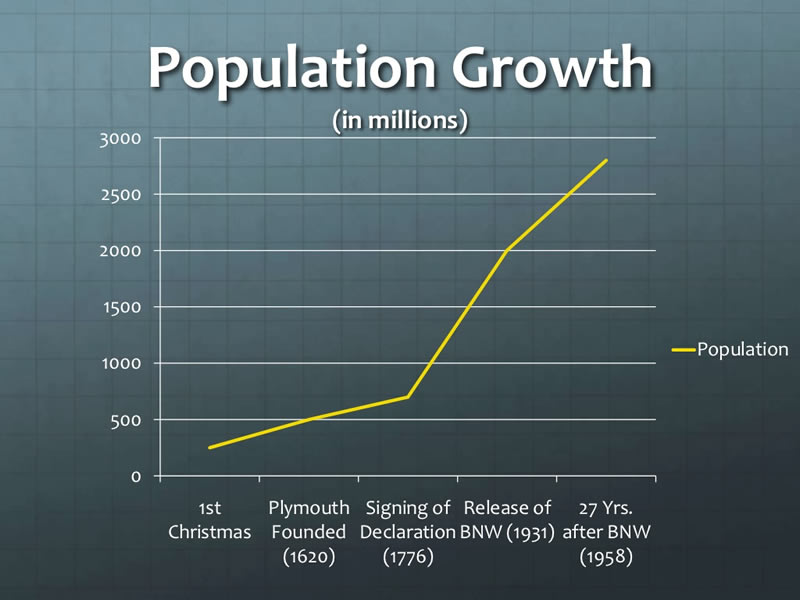

“At the rate of increase prevailing between the birth of Christ and the death of Queen Elizabeth I, it took sixteen centuries for the population of the earth to double. At the present rate it will double in less than half a century. And this fantastically rapid doubling of our numbers will be taking place on a planet whose most desirable and productive areas are already densely populated, whose soils are being eroded by the frantic efforts of bad farmers to raise more food, and whose easily available mineral capital is being squandered with the reckless extravagance of a drunken sailor getting rid of his accumulated pay.” –Aldous Huxley – Brave New World Revisited – 1958

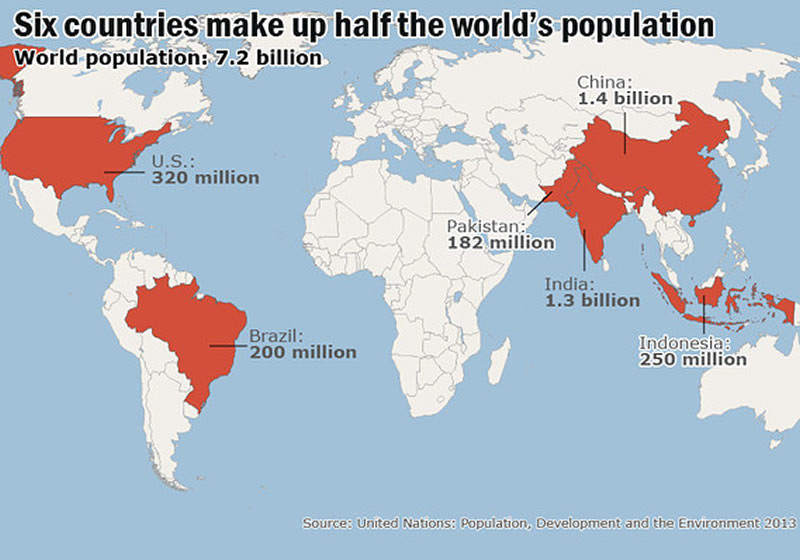

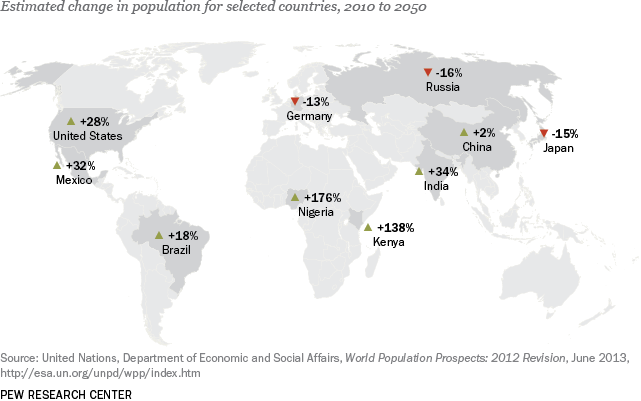

Demographics are easy to extrapolate and arrive at an accurate prediction, as long as the existing conditions and trends remain relatively constant. Huxley was accurate in his doubling prediction. The world population was 2.9 billion in 1958. It only took 39 years to double again to 5.8 billion in 1997. It has grown by 24% in the last 17 years to the current level of 7.2 billion. According to United Nations projections, world population is projected to reach 9.6 billion in 2050. The fact that it would take approximately 70 years for the world’s population to double from the 1997 level reveals a slowing growth rate, as the death rate in many developed countries surpasses their birth rate. The population of the U.S. grew from 175 million in 1958 to 320 million today, an 83% increase in 56 years.

The rapid population growth over the last century from approximately 1.8 billion in 1914, despite two horrific world wars, is attributable to cheap, easy to access oil and advances in medical technology made possible by access to cheap oil. The projection of 9.6 billion in 2050 is based upon an assumption the world’s energy, food and water resources can sustain that many people, no world wars kill a few hundred million people, no incurable diseases spread across the globe and there is no catastrophic geologic, climate, or planetary events. I’ll take the under on the 9.6 billion.

Anyone viewing the increasingly violent world situation without bias can already see the strain that overpopulation has created. Today, six countries contain half the world’s population.

A cursory examination of population trends around the world provides a frightening glimpse into a totalitarian future marked by vicious resource wars, violent upheaval and starvation for millions. India, a country one third the size of the United States, has four times the population of the United States. A vast swath of the population lives in poverty and squalor. India contains the largest concentration (25%) of people living below the World Bank’s international poverty line of $1.25 per day. According to the U.N. India is expected to add 400 million people to its cities by 2050. Its capital city Delhi already ranks as the second largest in the world, with 25 million inhabitants. The city has more than doubled in size since 1990. The assumptions in these U.N. projections are flawed. Without rapidly expanding economic growth, capital formation and energy resources, the ability to employ, house, feed, clothe, transport, and sustain 400 million more people will be impossible. Disease, starvation, civil unrest, war and a totalitarian government would be the result. With its mortal enemy Pakistan, already the sixth most populated country in the world, jamming 182 million people into an area one quarter the size of India and one twelfth the size of the U.S. and growing faster than India, war over resources and space will be inevitable. And both countries have nuclear arms.

More than half the globe’s inhabitants now live in urban areas, with China, India and Nigeria forecast to see the most urban growth over the next 30 years. Twenty-four years ago, there were 10 megacities with populations pushing above the 10 million mark. Today, there are 28 megacities with areas of developing nations seeing faster growth: 16 in Asia, 4 in Latin America, 3 in Africa, 3 in Europe and 2 in North America. The world is expected to have 41 sprawling megacities over the next few decades with developing nations representing the majority of that growth. Today, Tokyo, with 38 million people, is the largest in the world, followed by New Delhi, Jakarta, Seoul, Shanghai, Beijing, Manila, and Karachi – all exceeding 20 million people.