Are Plunging Petrodollar Revenues Behind The Fed’s Projected Rate Hikes?

January 21, 2015 by Administrator · Leave a Comment

If This Doesn’t Make You Mad…

Why is the Fed threatening to raise interest rates when the economy is still in the doldrums? Is it because they want to avoid further asset-price inflation, prevent the economy from overheating, or is it something else altogether? Take a look at the chart below and you’ll see why the Fed might want to raise rates prematurely. It all has to do with the sharp decline in petrodollars that are no longer recycling into US financial assets. This is from Reuters:

Petrodollar Exports

Source: Reuters“Energy-exporting countries are set to pull their ‘petrodollars’ out of world markets this year for the first time in almost two decades, according to a study by BNP Paribas. Driven by this year’s drop in oil prices, the shift is likely to cause global market liquidity to fall, the study showed…

This decline follows years of windfalls for oil exporters such as Russia, Angola, Saudi Arabia and Nigeria. Much of that money found its way into financial markets, helping to boost asset prices and keep the cost of borrowing down, through so-called petrodollar recycling.

This year, however, the oil producers will effectively import capital amounting to $7.6 billion. By comparison, they exported $60 billion in 2013 and $248 billion in 2012, according to the following graphic based on BNP Paribas calculations:

‘At its peak, about $500 billion a year was being recycled back into financial markets. This will be the first year in a long time that energy exporters will be sucking capital out,’ said David Spegel, global head of emerging market sovereign and corporate Research at BNP.

In other words, oil exporters are now pulling liquidity out of financial markets rather than putting money in. That could result in higher borrowing costs for governments, companies, and ultimately, consumers as money becomes scarcer.” (, Reuters)

Can you see what’s going on?

Now that petrodollar funding has dried up, the Fed needs to find an alternate source of capital to keep the markets bubbly and to shore up the greenback. That’s why the Fed has been talking up the dollar (“jawboning”) and promising to raise rates even though the economy is still pushing up daisies. According to the Fed’s favorite mouthpiece, Jon Hilsenrath:

“Federal Reserve officials are on track to start raising short-term interest rates later this year, even though long-term rates are going in the other direction amid new investor worries about weak global growth, falling oil prices and slowing consumer price inflation…

Many Fed officials have signaled they expect to start lifting their benchmark short-term rate from near zero around the middle of the year. Recent developments in the economy and markets have caused some trepidation among Fed officials and, if sustained, could cause them to delay acting. However several have indicated recently they still expect to move this year and are withholding judgment on delay.” (Fed Officials on Track to Raise Short-Term Rates Later in the Year, Jon Hilsenrath, Wall Street Journal)

And we’re hearing the same from Reuters: “The Federal Reserve is still on track for a potential mid-year interest-rate increase, a top Fed official said on Friday, citing strong U.S. economic momentum and a falling unemployment rate.”

Notice the sudden change in tone from dovish to hawkish? Expect that to intensify in the months ahead as the major media tries to spin the data in a way that serves the Fed’s broader objectives. Like this article in Bloomberg titled, “Yellen Signals She Won’t Babysit Markets in Turmoil”:

“Janet Yellen is leaving the Greenspan ‘put”’behind as she charts the first interest-rate increase since 2006 amid growing financial-market volatility.

The Federal Reserve chair has signaled she wants to place the economic outlook at the center of policy making, while looking past short-term market fluctuations. To succeed, she must wean investors from the notion, which gained currency under predecessor Alan Greenspan, that the Fed will bail them out if their bets go bad — just as a put option protects against a drop in stock prices.

“The succession of Fed puts over the years has led to a wide range of distortions in financial markets,” said Lawrence Goodman, president of the Center for Financial Stability, a monetary research group in New York. “There have been swollen asset values followed by sharp declines. This is a very good time for the Fed to move away.

“Let me be clear, there is no Fed equity market put,” William C. Dudley, president of the New York Fed, the central bank’s watchdog on financial markets, said in a Dec. 1 speech in New York.” (She’s No Greenspan: Yellen Signals She Won’t Babysit Markets in Turmoil)

“There’s no Fed equity put”?

That’s ridiculous. Then how does one explain the way the Fed has launched additional rounds of QE every time stocks have started to sputter? And how does one explain the Fed’s $4 trillion balance sheet all of which was spent on financial assets?

Let’s face it, Central bank intervention has been the only game in town. It’s not just the main driver of stocks. It’s the only driver of stocks. Everyone knows that. Yellen is going to do everything in her power to keep stocks in the stratosphere just like her predecessors, Greenspan and Bernanke. The only that’s going to change, is her approach.

As for the economy, well, just a glance of the headlines tells the whole story. Like this gem from CNBC last week:

“U.S. consumer prices recorded their biggest decline in six years in December and underlying inflation pressures were benign,…The Labor Department said on Friday its Consumer Price Index fell 0.4 percent last month, the largest drop since December 2008, after sliding 0.3 percent in November. In the 12 months through December, CPI increased 0.8 percent…

Darkening prospects for the global economy could also complicate matters for the U.S. central bank.

Inflation is running below the Fed’s 2 percent target, despite a strengthening labor market and overall economy.” (Consumer Price Index drops 0.4% in December, in line with estimates, CNBC)

Think about that for a minute: Consumer prices just logged their biggest drop since the freaking slump of 2008 and, yet, the Fed is still babbling about raising rates.

Talk about lunacy. Not only has the Fed not reached its inflation target of 2%, but it’s abandoned the project altogether. Why? Why has the Fed suddenly stopped trying to boost inflation when the yields on benchmark 10-year US Treasuries have just plunged to record lows (1.70%) and are blinking red? In other words, the bond market is signaling slow growth and zero inflation for as far as the eye can see, but the Fed wants to raise rates and slash growth even more?? It doesn’t make any sense, unless of course, Yellen has something else up her sleeve. Which she does.

Now get a load of this shocker on retail sales in last week’s news. This is from Bloomberg:

“The optimism surrounding the outlook for U.S. consumers was taken down a notch as retail sales slumped in December by the most in almost a year, prompting some economists to lower spending and growth forecasts.

The 0.9 percent decline in purchases …. extended beyond any single group as receipts fell in nine of 13 major retail categories.

…

Treasury yields and stocks fell as a deepening commodities rout and the drop in sales spurred concern global growth is slowing……average hourly earnings falling 0.2 percent in December from the month before in the first drop since late 2012. That limits the amount of spending consumers can undertake without dipping into savings or racking up debt.” (U.S. Retail Sales Down Sharply, Likely Cuts to Growth Forecasts Ahead, Bloomberg)

Remember when everyone thought that low oil prices were going to save the economy? It hasn’t worked out that way though, has it? Nor will it. Falling oil prices usually indicate recession, crisis or deflation. Take your pick. They’re usually not a sign of green shoots, escape velocity, or sunny uplands.

And did you catch that part about falling wages? How do you expand a consumer-dependent economy, when workers are seeing their wages shrivel every month? In case, you haven’t seen the abysmal stagnation of wages in graph-form, here’s a chart from American Progress:

Negative real wage growth means the amount of slack in the market is still considerable.

So while stock prices have doubled or tripled in the last 6 years, wages have basically been flatlining. That’s a pretty crummy distribution system, don’t you think. Unless you’re in the 1 percent of course, then everything is just hunky dory.

But at least Yellen can find some comfort in the fact that unemployment continues to improve. In fact, just two weeks ago unemployment dropped to an impressive 5.4%, the lowest since 2007. So if we forget about the fact that wages are stagnating, that management has nabbed all the productivity-gains for the last 40 years, and that another 451,000 workers dropped off the radar altogether in December, then everything looks pretty rosy. But, of course, it’s all just a bunch of baloney. Take a look at this from Zero Hedge:

“Another month, another attempt by the BLS to mask the collapse in the US labor force with a seasonally-adjusted surge in waiter, bartender and other low-paying jobs. Case in point… the labor participation rate just slid once more, dropping to 62.7%, or the lowest print since December 1977. This happened because the number of Americans not in the labor forced soared by 451,000 in December, far outpacing the 111,000 jobs added according to the Household Survey, and is the primary reason why the number of uenmployed Americans dropped by 383,000.

(Labor Participation Rate Drops To Fresh 38 Year Low; Record 92.9 Million Americans Not In Labor Force, Zero Hedge)

So, yeah, unemployment looks great until you pick through the data and see it’s all a big fraud. Unemployment is only falling because more and more people are throwing in the towel and giving up entirely.

Finally, there’s the rapidly-expanding mess in the oil patch where the news on layoffs and cut backs gets worse by the day. This is from Wolf Richter at Naked Capitalism:

“Layoffs are cascading through the oil and gas sector. On Tuesday, the Dallas Fed projected that in Texas alone, 140,000 jobs could be eliminated. Halliburton said that it was axing an undisclosed number of people in Houston. Suncor Energy, Canada’s largest oil producer, will dump 1,000 workers in its tar-sands projects. Helmerich & Payne is idling rigs and cutting jobs. Smaller companies are slashing projects and jobs at an even faster pace. And now Slumberger, the world’s biggest oilfield-services company, will cut 9,000 jobs.” (Money dries up for oil and gas, layoffs spread, write-offs start, Wolf Richter, Naked Capitalism)

And then there’s this tidbit from Pam Martens at Wall Street on Parade:

“In a December 15 article by Patrick Jenkins in the Financial Times, readers learned that data from Barclays indicated that “energy bonds now make up nearly 16 per cent of the $1.3 trillion junk bond market — more than three times their proportion 10 years ago,” and “Nearly 45 per cent of this year’s non-investment grade syndicated loans have been in oil and gas.” Raising further alarms, AllianceBernstein has released research suggesting that the deals were not fully subscribed by investors with the potential that “as much as half of the outstanding financing from the past couple of years may be stuck on banks’ books.” (The perfect storm for Wall Street banks, Russ and Pam Martens, Wall Street on Parade)

How do you like that? So nearly half the toxic energy-related gunk that was bundled up into dodgy junk bonds (and is likely to default in the near future) is sitting on bank balance sheets. Does that sound like a potential trigger for another financial crisis or what?

And, no, I am not trying to ignore the fact that third quarter GDP came in at a whopping 5 percent which vastly exceeded all the analysts estimates. But let’s put that into perspective. According to economist Dean Baker, the growth spurt was mainly “an anomaly” …”driven by extraordinary jump in military spending and a big fall in the size of the trade deficit that is unlikely to be repeated.” Here’s more from Baker:

“As usual, just about everything we’ve heard about the economy is wrong. To start, the 5.0 percent growth number must be understood against a darker backdrop: The economy actually shrank at a 2.1 percent annual rate in the first quarter. If we take the first three quarters of the year together, the average growth rate was a more modest 2.5 percent.” (Don’t Believe What You Hear About the US Economy, Dean Baker, CEPR)

So, the economy is growing at a crummy 2.5 percent, but Yellen wants to raise rates. Why? Does she want to shave that number to 2 percent or 1.5 percent? Is that it? She wants to go backwards?

Of course not. The real reason the Fed wants to raise rates, is to attract foreign capital to US markets in order to keep stocks soaring, keep borrowing costs low, and reinforce the dollar’s role as the world’s reserve currency. That’s what’s really going on. The petrodollars are drying up, so US markets need a new source of funding. Direct foreign investment, that’s the ticket, Ducky. All the Fed needs to do is boost rates by, let’s say, 0.5 percent and “Cha-ching”, here comes the capital. Works like a charm every time, just ask former Treasury Secretary Robert Rubin whose strong dollar policy sent stock prices into orbit while widening the nation’s current account deficit by many orders of magnitude. (We never said the plan didn’t have its downside.)

The Fed’s sinister plan to raise interest rates (sometime by mid-2015) will push the dollar’s exchange rate higher thus triggering capital flight in the emerging markets which are already struggling with plunging commodities prices and an excruciating slowdown. The investment flows from the EMs to US financial assets and Treasuries will offset the loss of petrodollar revenue while expanding Wall Street’s ginormous stock market bubble. As for the emerging markets, well, they’re going to take it in the shorts bigtime as one would expect. Here’s a clip from an article by Ambrose-Evans Pritchard that lays it out in black and white:

“The US Federal Reserve has pulled the trigger. Emerging markets must now brace for their ordeal by fire. They have collectively borrowed $5.7 trillion in US dollars, a currency they cannot print and do not control. This hard-currency debt has tripled in a decade, split between $3.1 trillion in bank loans and $2.6 trillion in bonds. It is comparable in scale and ratio-terms to any of the biggest cross-border lending sprees of the past two centuries…

Officials from the Bank for International Settlements say privately that developing countries may be just as vulnerable to a dollar shock as they were in the Fed tightening cycle of the late 1990s, which culminated in Russia’s default and the East Asia Crisis. The difference this time is that emerging markets have grown to be half the world economy. Their aggregate debt levels have reached a record 175pc of GDP, up 30 percentage points since 2009…”

This time the threat does not come from insolvent states. They have learned the lesson of the late 1990s. Few have dollar debts. But their companies and banks most certainly do, some 70pc of GDP in Russia, for example. This amounts to much the same thing in macro-economic terms. ” (Fed calls time on $5.7 trillion of emerging market dollar debt, Ambrose-Evans Pritchard, Telegraph)

The Fed has been through this drill so many times before they could do it in their sleep. (” U.S. interest-rate hikes in 1980s and 1990s played a role in financial crises across Latin America and East Asia.” Foreign Policy Magazine) They’ve learned how to profit off every crisis, particularly the one’s that they themselves create, which is just about all of them. In this case, most of the loans to foreign businesses and banks were denominated in dollars. So, now that the dollar is soaring, (“The dollar’s value has risen about 15 percent relative to the euro and the yen just since the summer.” NPR) the debts are going to balloon accordingly (in real terms) which is going to push a lot of businesses off a cliff forcing sovereigns to step in and provide emergency bailouts.

Did someone say “looming financial crisis”?

Indeed. Bernanke’s “easy money” has inflated bubbles across the planet. Now these bubbles are about to burst due to the strong dollar and anticipated higher rates. At the same time, the policy-switch will send hundreds of billions of foreign capital flooding into US markets pushing stocks and bonds through the roof while generating mega-profits for JPM, G-Sax and the rest of the Wall Street gang. All according to plan.

Naturally, the stronger dollar will weigh heavily on employment and exports as foreign imports become cheaper and more attractive to US consumers. That will reduce hiring at home. Also the current account deficit will widen significantly, meaning that the US will again be consuming much more than it produces. (This took place under Rubin, too.) But here’s what’s interesting about that: According to the Bureau of Economic Analysis: “Our current account deficit has narrowed sharply since the crisis…The U.S. current account deficit now stands at 2.5 percent of GDP, down from more than 6 percent in the fourth quarter of 2005.” (BEA)

Great. In other words, Obama’s obsessive fiscal belt-tightening lowered the deficits enough so that Wall Street can “party on” for the foreseeable future, ignoring the gigantic bubbles they’re inflating or the emerging market economies that are about to be decimated in this latest dollar swindle.

If that doesn’t make you mad, I don’t know what will.

Mike Whitney is a regular columnist for Veracity Voice

Mike Whitney lives in Washington state. He can be reached at:

Oil Price Blowback

January 10, 2015 by Administrator · Leave a Comment

Is Putin Creating A New World Order?

“If undercharging for energy products occurs deliberately, it also effects those who introduce these limitations. Problems will arise and grow, worsening the situation not only for Russia but also for our partners.” – Russian President Vladimir Putin

It’s hard to know which country is going to suffer the most from falling oil prices. Up to now, of course, Russia, Iran and Venezuela have taken the biggest hit, but that will probably change as time goes on. What the Obama administration should be worried about is the second-order effects that will eventually show up in terms of higher unemployment, market volatility, and wobbly bank balance sheets. That’s where the real damage is going to crop up because that’s where red ink and bad loans can metastasize into a full-blown financial crisis. Check out this blurb from Nick Cunningham at Oilprice.com and you’ll see what I mean:

“According to an assessment from the Federal Reserve Bank of Dallas, an estimated 250,000 jobs across eight U.S. states could be lost in 2015 if oil prices don’t rise. More than 50 percent of those job losses would occur in Texas, which leads the nation in oil production.

There are some early signs that a slowdown in drilling could spread to the manufacturing sector in Texas… One executive at a metal manufacturing company said in the survey, “the drop in crude oil prices is going to make things ugly… quickly.” Another company that manufactures machinery told the Dallas Fed, “Low oil prices will drive reductions in U.S. drilling rigs, which will in turn reduce the market for our products.”

The sentiment was similar for a chemical manufacturer, who said “lower oil prices will adversely impact margins. Energy volatility will cause our customers to keep inventories tight.”

States like Texas, North Dakota, Oklahoma, and Louisiana have seen their economies boom over the last few years as oil production surged. But the sector is now deflating, leaving gashes in employment rolls and state budgets.” (Low Prices Lead To Layoffs In The Oil Patch, Nick Cunningham, Oilprice.com)

Of course industries lay-off workers all the time and it doesn’t always lead to a financial crisis. But unemployment is just one part of the picture, lower personal consumption is another. Take a look:

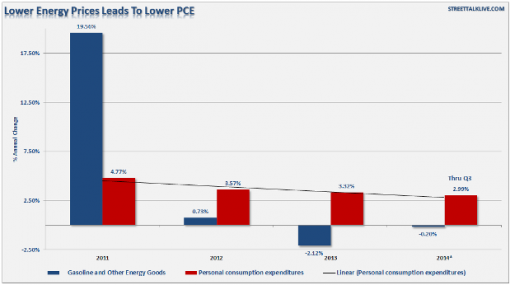

“Falling oil prices are a bigger drag on economic growth than the incremental “savings” received by the consumer…..Another way to show this graphically is to look at the annual changes in Personal Consumption Expenditures (PCE) in aggregate as compared to the subsection of PCE spent on energy and related products. This is shown in the chart below.

Lower Energy Prices To Lower PCE (Personal Consumption Expenditures):

(The Gasoline Price Myth, Lance Roberts, oilprice.com)

See? So despite what you might have read in the MSM, lower gas prices do not translate into greater personal consumption or more robust growth. Quiet the contrary, they tend to intensify deflationary pressures and reduce activity which is a damper on growth.

Then there’s the knock-on effects that crashing prices and layoffs have on other industries like mining, manufacturing and chemical production. Here’s more from Oil Price:

“Oil and gas production makeup a hefty chunk of the “mining and manufacturing” component of the employment rolls. Since 2000, when the oil price boom gained traction, Texas has comprised more than 40% of all jobs in the country according to first quarter data from the Dallas Federal Reserve…

The majority of the jobs “created” since the financial crisis have been lower wage paying jobs in retail, healthcare and other service sectors of the economy. Conversely, the jobs created within the energy space are some of the highest wage paying opportunities available in engineering, technology, accounting, legal, etc. In fact, each job created in energy related areas has had a “ripple effect” of creating 2.8 jobs elsewhere in the economy from piping to coatings, trucking and transportation, restaurants and retail….

The obvious ramification of the plunge in oil prices is that eventually the loss of revenue will lead to cuts in production, declines in capital expenditure plans (which comprise almost 1/4th of all capex expenditures in the S&P 500), freezes and/or reductions in employment, and declines in revenue and profitability…

Simply put, lower oil and gasoline prices may have a bigger detraction on the economy than the “savings” provided to consumers.” (The Gasoline Price Myth, Lance Roberts, oilprice.com)

None of this sounds very reassuring, does it? And yet, all we hear from the media is how the economy is going to reach “escape velocity” on the back of cheap oil. Nonsense. This is just more “green shoots” baloney wrapped in public relations hype. The fact is, the economy needs the good-paying jobs more than it needs low-priced energy. But now that prices are tumbling, those jobs are going to disappear which is going to be a drag on growth. Now check out these headlines I picked up on Google News that help to show what’s going on off the radar:

“Texas is in danger of a recession”, CNN Money.

“Texas Could Be Headed for an Oil-Fueled Recession, JP Morgan Economist Says”, Wall Street Journal “Good Times From Texas to North Dakota May Turn Bad on Oil-Price Drop”, Bloomberg

“Low Oil Prices in the New Year Are Screwing Petrostates”, Vice News

“Top US Oil States Are Taking A Hit From Plunging Crude Prices”, Business Insider

Get the picture? If oil prices continue to fall, unemployment is going to spike, activity is going to slow, and the economy is going tank. And the damage won’t be limited to the US either. Get a load of this from the UK Telegraph:

“A third of Britain’s listed oil and gas companies are in danger of running out of working capital and even going bankrupt amid a slump in the value of crude, according to new research.

Financial risk management group Company Watch believes that 70pc of the UK’s publicly listed oil exploration and production companies are now unprofitable, racking up significant losses in the region of £1.8bn.

Such is the extent of the financial pressure now bearing down on highly leveraged drillers in the UK that Company Watch estimates that a third of the 126 quoted oil and gas companies on AIM and the London Stock Exchange are generating no revenues.

The findings are the latest warning to hit the oil and gas industry since a slump in the price of crude accelerated in November when the Organisation of Petroleum Exporting Countries (Opec) decided to keep its output levels unchanged. The decision has caused carnage in oil markets with a barrel of Brent crude falling 45pc since June to around $60 per barrel.” (Third of listed UK oil and gas drillers face bankruptcy, Telegraph)

“Carnage in oil markets,” you say?

Indeed. Many of the oil-drilling newcomers set up shop to take advantage of the low rates and easy money available in the bond market. Now that prices have crashed, investors are avoiding energy-related junk bonds like the plague which is making it impossible for the smaller companies to roll over their debt or attract fresh capital. When these companies start to default en masse, as they certainly will if prices don’t rebound, the blowback will be felt on bank balance sheets across the country creating the possibility of another financial meltdown. (Now we ARE talking about a financial crisis.)

The basic problem is that the banks have bundled a lot of their dodgy debt into financially-engineered products like Collateralized Loan Obligations (CLOs) and Collateralized Debt Obligations (CDOs) that will inevitably fail when borrowers are no longer able to service the loans. The rot can be concealed for a while, but eventually, if prices don’t recover, a significant number of these companies are going to go under which will push the perennially-undercapitalized banking system to the brink once again. That’s why Washington’s plan to push down oil prices (to hurt the Russian economy) might have made sense on a short-term basis (to shock Putin into submission) but as a long-term strategy, it’s nuts. And what’s even crazier, is that Obama has decided to double-down on the same wacky plan even though Putin hasn’t given an inch. Check this out from Reuters on Monday:

“The Obama administration has opened a new front in the global battle for oil market share, effectively clearing the way for the shipment of as much as a million barrels per day of ultra-light U.S. crude to the rest of the world…

The Department of Commerce on Tuesday ended a year-long silence on a contentious, four-decade ban on oil exports, saying it had begun approving a backlog of requests to sell processed light oil abroad.

The action comes at a critical juncture for the global oil market. World prices have halved to less than $60 a barrel since the summer as top exporter Saudi Arabia, once a staunch defender of $100 oil, refused to cut production in the face of surging U.S. shale output and tempered global demand…

With global oil markets in flux, it is far from clear how much U.S. condensate will find a market overseas.”

(Analysis – U.S. opening of oil export tap widens battle for global market, Reuters)

Does that make sense to you, dear reader? Why would Obama suddenly opt to change the rules of the game when he knows it will increase supply and push prices down even further? Why would he do that? Certainly, he doesn’t want to inflict more pain on domestic producers, does he?

Let’s let Obama answer the question for himself. Here’s a clip from an NPR interview with the president just last week. About halfway through the interview, NPR’s Steve Inskeep asks Obama: “Are you just lucky that the price of oil went down and therefore their currency collapsed or …is it something that you did?

Barack Obama: If you’ll recall, their (Russia) economy was already contracting and capital was fleeing even before oil collapsed. And part of our rationale in this process was that the only thing keeping that economy afloat was the price of oil. And if, in fact, we were steady in applying sanction pressure, which we have been, that over time it would make the economy of Russia sufficiently vulnerable that if and when there were disruptions with respect to the price of oil — which, inevitably, there are going to be sometime, if not this year then next year or the year after — that they’d have enormous difficulty managing it.” (Transcript: President Obama’s Full NPR Interview)

Am I mistaken or did Obama just admit that he wanted “disruptions” in the “price of oil” because he figured Putin would have “enormous difficulty managing it”?

Isn’t that the same as saying that it was all part of Washington’s plan; that plunging prices were just the icing on the cake for their asymmetrical attack on the Russian economy? It sure sounds like it. And that would also explain why Obama decided to allow domestic producers to dump more oil on the market even though it’s going to send prices lower. Apparently, none of that matters as long as the policy hurts Russia.

So maybe the US-Saudi oil collusion theory isn’t so far fetched after all. Maybe Salon’s Patrick L. Smith was right when he said:

“Less than a week after the Minsk Protocol was signed, Kerry made a little-noted trip to Jeddah to see King Abdullah at his summer residence. When it was reported at all, this was put across as part of Kerry’s campaign to secure Arab support in the fight against the Islamic State.

Stop right there. That is not all there was to the visit, my trustworthy sources tell me. The other half of the visit had to do with Washington’s unabated desire to ruin the Russian economy. To do this, Kerry told the Saudis 1) to raise production and 2) to cut its crude price. Keep in mind these pertinent numbers: The Saudis produce a barrel of oil for less than $30 as break-even in the national budget; the Russians need $105.

Shortly after Kerry’s visit, the Saudis began increasing production, sure enough — by more than 100,000 barrels daily during the rest of September, more apparently to come…

Think about this. Winter is coming, there are serious production outages now in Iraq, Nigeria, Venezuela and Libya, other OPEC members are screaming for relief, and the Saudis make back-to-back moves certain to push falling prices still lower? You do the math, with Kerry’s unreported itinerary in mind, and to help you along I offer this from an extremely well-positioned source in the commodities markets: “There are very big hands pushing oil into global supply now,” this source wrote in an e-mail note the other day.” (“What Really Happened in Beijing: Putin, Obama, Xi And The Back Story The Media Won’t Tell You”, Patrick L. Smith, Salon)

Vladimir Putin: Public Enemy Number 1

Let’s cut to the chase: All these oil shenanigans are really aimed at just one man: Vladimir Putin. There are a number of reasons why Washington wants to get rid of Putin, the first of which is that the Russian president has become an obstacle to US plans to pivot to Asia. That’s the main issue. As long as Putin is calling the shots, there’s going to be growing resistance to NATO’s push eastward and Washington’s military expansion across Central Asia which could undermine US plans to encircle China and remain the world’s only superpower. Here’s an excerpt from Zbigniew Brzezinski’s The Grand Chessboard which helps to explain the importance Eurasia is in terms of Washington’s global ambitions:

“..how America ‘manages’ Eurasia is critical. A power that dominates Eurasia would control two of the world’s three most advanced and economically productive regions. A mere glance at the map also suggests that control over Eurasia would almost automatically entail Africa’s subordination, rendering the Western Hemisphere and Oceania (Australia) geopolitically peripheral to the world’s central continent. About 75 per cent of the world’s people live in Eurasia, and most of the world’s physical wealth is there as well, both in its enterprises and underneath its soil. Eurasia accounts for about three-fourths of the world’s known energy resources.” (p.31) (Zbigniew Brzezinski, The Grand Chessboard: American Primacy And It’s Geostrategic Imperatives, Key Quotes From Zbigniew Brzezinksi’s Seminal Book)

Get it? Prevailing in Asia is the administration’s top priority, which is why the US is rapidly moving its military assets into place. Check this out from the World Socialist Web Site:

“Under Obama’s “pivot to Asia,” the Pacific Command will account for more than 60 percent of all US military forces, up from 50 percent under the Bush administration. This includes new US basing arrangements in the Philippines, Singapore and Australia, as well as renewed close military ties to New Zealand, and ongoing US military exercises in Thailand, Malaysia, Indonesia and Taiwan….(as well as) large troop deployments in Japan and South Korea, including nuclear-armed units.” (The global scale of US militarism, Patrick Martin, World Socialist Web Site)

The “Big Shift” is already underway, which is why obstacles have to be removed and Putin’s got to go.

Second, Putin has made himself a general nuisance vis a vis US strategic objectives in Syria, Iran and Ukraine. In Syria, Putin has thrown his support behind Assad who the US wants to topple in order to redraw the map of the Middle East and build gas pipelines from Qatar to Turkey to access the lucrative EU market.

Third, Putin has strengthened a number of coalitions and alliances –the BRICS bank, the Eurasian Economic Union, and the Shanghai Cooperation Organization–all of which pose a challenge to US dominance in the region as well as a viable alternative to neoliberal financial institutions like the IMF and World Bank. Going back to Brzezinski’s “chessboard” once again, we see that the US should not feel threatened by any one nation, but should be constantly on-the-lookout for “regional coalitions” which could derail its plans to rule the world. Here’s Brzezinski again:

“…the three grand imperatives of imperial geostrategy are to prevent collusion and maintain security dependence among the vassals, to keep tributaries pliant and protected, and to keep the barbarians from coming together.” (p.40)

“Henceforth, the United States may have to determine how to cope with regional coalitions that seek to push America out of Eurasia, thereby threatening America’s status as a global power.” (p.55) (Zbigniew Brzezinski, The Grand Chessboard: American Primacy And It’s Geostrategic Imperatives, Key Quotes From Zbigniew Brzezinksi’s Seminal Book)

As a founding member and primary backer of these organizations, (and initiator of giant energy deals with China, India and Turkey) Putin has become Washington’s biggest headache and a logical target for regime change.

Finally, Putin is doing whatever he can to circumvent dollar-denominated business and financial transactions. The move away from the buck is a direct attack on the US’s greatest source of power, the ability to control the de facto international currency and to require that other nation’s stockpile dollars for their energy purchases which are then recycled into US financial assets, stocks bonds and US Treasuries. This petrodollar-recycling scam allows the US to run gigantic current account deficits without raising interest rates or reducing government spending. Putin’s anti-dollar policies could diminish the greenback’s role as reserve currency and put an end to a system that institutionalizes looting.

This is why Putin is Public Enemy Number 1. It’s because he’s blocking the US pivot to Asia, strengthening anti-Washington coalitions, sabotaging US foreign policy objectives in the Middle East, creating institutions that rival the IMF and World Bank, transacting massive energy deals with critical US allies, increasing membership in an integrated, single-market Eurasian Economic Union, and attacking the structural foundation upon which the entire US empire rests, the dollar.

Naturally, Washington’s powerbrokers are worried about these developments, just as they are worried about the new world order which is gradually taking shape under Putin’s guidance. But, so far, they haven’t been able to do anything about it. The administration’s regime change schemers and fantasists have shown time-and-again that they’re no match for Bad Vlad who has beaten them at every turn.

Bravo, Putin.

Mike Whitney is a regular columnist for Veracity Voice

Mike Whitney lives in Washington state. He can be reached at:

As Aleppo Goes, So Goes Syria?

January 3, 2015 by Administrator · Leave a Comment

Were a visitor to arrive at the embattled city of Aleppo these frigid and bleak days from the western government controlled side of the 7000 year old city, even if blindfolded and wearing tight earplugs the sightless and deaf traveler would likely sense something very different from what he experiences in Damascus and other cities in Syria.

Somehow, a visitor just feels it in the ambient atmosphere. Something–expectations, pressure, anticipation, dread, anguish, excitement is rapidly building and seemingly is about to impact profoundly events in this war that has killed nearly a quarter million people, wounded more than one million and forced more than 3 million to flee Syria while displacing half of the remaining population that once numbered 23 million. With no end even faintly in sight.

Aleppo has been and remains, along with Damascus, the strategic area which is critical to both sides of the chaotically stalemated conflict. The victor in Aleppo will achieve momentum which some military experts claim will lead them to control much of Syria and certainly nearly all of the major population centers. Aleppo is crucial for both sides as pressure builds daily and as many Aleppines are expressing a sense that some powerful dynamic in about to occur leading toward a resolution of the four year civil war or perhaps leading to even more abject horror.

None of us knows of course but this observer wondered the other day if this is what his host, the commander of government forces in the old city souk in Aleppo had in mind when he looked up toward the nearby ancient Citidel where his troops are finally stationed after two years of fighting opposition forces. But what did he mean when he cryptically said, “In three days my friend you will see something happen here that will have major consequences, enshallah (god willing) for the good of the Syrian people and my country.”

Well, in the following three days nothing particularly major seemed to happen in the neighborhood where this observer has been staying the western section of Aleppo. The usual thuds of mortars and artillery and aircraft screaming across the sky followed by bomb blasts and passersby often squinting skyward and shrugging at visitors as they hurry on their way.

On the third day in Idlib, rebels and Nusra Front militants did seize at least three government checkpoints near two military bases, Wadi Deif and Hamidiyeh which straddle an important supply route in Idlib Province to the southwest. This achievement suggests al Nusra achieves occasional dominance over the Syrian army. Yet almost immediately government combat aircraft bombed the Bab town area of Aleppo, an area controlled by Da’ish (IS) which are increasingly collaborating with Nusra in some areas. Rebels hav also been active recently to the southwest adding more pressure on government forces that are currently scattered over a large area vaguely surrounding Allepo and fighting to capture it from rebels still building up their forces in the east, north and northwest of the city.

Or did the commander mean the reportedly rapid in-gathering of Hezbollah and Iranian fighters who many believe are preparing a Qalamoun type offensive from the west aimed at cutting supplies lines to rebels forces? Its hard to know, but when we last visited his compound on the fifth day, for sure it had changed, presumably in anticipation of something significant about to be unleashed. The hallways of his three level HQ were now neatly stacked to the ceilings with rockets and ammunition of various kinds. One of his aides joked that he hoped Da’ish or Nusra was not digging another tunnel in the area. With a grimace, his commander explained that his men have only a little outdated Soviet era tunnel detection equipment that does not work well so they rely on literally keeping their ears to the ground to detect deadly tunneling sounds. Rebel tunneling that led to the nearby 150 year old Carlton Citadel Hotel being completely demolished on 8 May 2014. The blast from a tunnel underneath killed between 14 and 50 people depending of which source one credits. Da’ish claims it was being used as an army barracks. As this observer stumbled alongside army guys whispering into their radios as we climbed through the Carlton Hotel rubble in pitch blackness toward the Citadel, he was advised that some bodies under the rubble had still not been recovered seven months later and he sensed fear in his guides about tunnels being dug below. A well-grounded nervousness because on 12/30/14 a powerful blast from explosives planted in a tunnel near the HQ this observer visited reportedly, by a new rebel coalition in Aleppo called Jabha Shamiyeh, killed or wounded more than 30 soldiers.

Both sides and their allies are getting exhausted with reported increased desertions from both sides and intensifying complaints from the population. Syria’s allies are growing weary of a conflict that could last decades without clear benefits to any side. Russia is tired with major economic problems looming. The recent collapse in oil prices and Western sanctions have battered the Russian economy which has fallen into decline for the first time in five years, according to official figures. This forced drastic interventions from the Russian Central Bank and appears to be creating the biggest crisis in Vladimir Putin’s leadership of the country. Russia’s economy ministry said GDP had fallen by 0.5pc in the year to November, the latest sign that the country is heading for recession.

With respect to Iran, despite repeated assurances from its leaders that the US led sanctions have been defeated, it still faces severe economic problems as well as the growing loss of al Quds commanders in Syria and Iraq leading to increasing criticism of the regimes involvement in both countries and even Lebanon from the Iranian people.

Iran’s worst nightmare in Iraq and Syria and perhaps soon in Lebanon is Da’ish (IS) and Nusra black flags fluttering on the horizon Both have left little doubt that they view Shia as a cult of apostates who tried to hijack Islam in the 7th Century and need to be eradicated or at a minimum converted and watched closely. On 12/19/14 a suicide bomber, presumably from Da’ish (IS) or Nusra attacked Shiite pilgrims on their way to a shrine at Samarra in the Taji area north of Baghdad again, this time killing at least 17 people and wounding more than 35. This as they have recently launched a campaign to liberate Syria and Iraq from what they claim now nearly total Iranian occupation. Da’ish has launched a social media campaign among Sunni tribes to eliminate once and for all Shia and return Islam to the Caliphate of and by Mohammad the Prophet. One Da’ish adviser discussed with this observer how Iran’s regime has become vulnerable and ripe for removal by the people of Iran due to the same forces plaguing Hezbollah. That is trying to justify to their supporters why they are in Iraq and Syria killing Sunni and Shia alike instead of getting serious about dialogue and salvaging these countries. Time is claimed to be on the side of Da’ish by its spokesmen given the perceived depth of corruption and illegitimacy of rulers in the region and increasingly restive populations.

One student I met at the restaurant in Aleppo explained as only an inspired student seems to be able and willing to do these days: “Change is coming. Deep change. The corrupt incompetents and religious fanatics on all both sides will be swept away. What you are seeing these days in our region are only mild soft tremors presaging the next phase. Frankly, I put religions at the top of my personal Terrorism List.”

Hezbollah is under increasing pressure, even within the Shia community, to leave Syria and Iraq partly because their supporters have tired of seeing posters of their dead sons plastered around the Bekaa, South Beirut, and South Lebanon. Hezbollah leaders have never really convinced many people of its necessity to fight in Syria and Iraq to keep the “terrorist and takfiris” out of Lebanon. According to virtually every poll taken, a majority of Lebanese believe the opposite- believing that IS and Al Nusra are coming here because Hezbollah went there and created a magnate for jihadists to fight them and target their strongholds. Meanwhile some right-wing Israeli politicians, if not the Northern Command, reportedly claim Hezbollah is over stretched and they fantasize about ‘ turf furloughing’ in Lebanon’ and carpet bombing Hezbollah much more severely than during its most recent genocidal ‘lawn-mowing’ in Gaza.

Against this backdrop, maybe the subject most frequently discussed these days with foreign visitors to Aleppo is the urgent need for a ceasefire leading to a negotiated settlement. So the time may be ripe for a ceasefire in Aleppo. One idea is to establish a ‘stand down models’ or ‘freeze zones” to be put into place across Syria in order to stop the seemingly interminable slaughter. UN envoys UN Envoy Staffan De Mistura’s proposal for a ‘freeze’ and the fast approaching Jan. 26-29 Moscow talks could be what the army commander had in mind. Part of De Mistura’s goal is to secure a ceasefire that would allow humanitarian aid to reach those in dire need. He has warned the fall of Aleppo would likely create an additional 400,000 refugees.

The ‘freeze’ proposal was within three days of the commanders prediction and if adopted by the parties could spread to other areas and conceivable lead to a ceasefire and then to peace talks as being promoted by Russia and being studied by the Assad government. The Foreign Ministry told the media this week that “Syria is ready to participate in preliminary consultations in Moscow in order to meet the aspirations of Syrians to find a way out of crisis.”

One example of ‘freezing the conflict in Aleppo” movement, as a step toward a broader settlement along the lines proposed by is the 12/29/14 action by Syrian army allowing more than 30 besieged families and some armed men who surrendered, “safe passage” out of from Douma and Zibdin in Eastern Ghouta adjoining Damascus. There are also rumors that male evacuees might be recruited into a pro-regime militia. The evacuation was the second since December 9, when 76 families were allowed out of Douma.

According to Freeze proponents, this plan to freeze the fighting in Aleppo is the only hopeful one available. De Mistura has said he sees no hope for another plan and it is the only plan capable of freezing the fighting, securing people’s needs and returning the displaced people who are burdening neighboring areas and states. It will also allow for the eventual process of reconstruction he and many others insist. Regime supporters argue that Syrian President Assad is showing readiness to ensure the success of the international plan in Aleppo, and that he convinced Russian President Vladimir Putin of the plan while convincing his Iranian allies as well.

The White House, despite reservations, appears more flexible this week, linking their approval with that of some of their regional allies, meaning Saudi Arabia, Jordan and the Persian Gulf countries. Two rounds of Geneva talks early in 2014 failed to halt the conflict and some claimed actually inflamed it.

A Syrian gentleman who speaks regularly to security officials and leaders from Mr. Assad’s minority Alawite sect, an important component of his base, said recently that a growing numbers across the political spectrum now are insisting on a political settlement despite others still insisting on a fight to the death. One angry gentleman, exhibiting a ‘no turning back’ mentality and who lost his home, family and all hope for recovery, emphasized to this observer, that, “What happens to us during this period is not important. What matters is how history will judge us 1000 years from now.”

And so the Syrian civil war goes on. As Red Cross Dr David Nott who returned to Aleppo recently to help treat victims presented a gloomy assessment while describing the nearly complete breakdown of medical treatment in the city. He explained that more than 80% of patients requiring urgent treatment now die as a result of their injuries or lack of basic care, medicine and equipment. A plunge in vaccination rates from 90 percent before the war to 52 percent this year and contaminated water is allowing typhoid and hepatitis to spread and over half of public hospitals are closed resulting in treatments for diseases and injuries being erratic. More than 6,500 cases of typhoid and 4,200 cases of measles, the deadliest disease for Syrian children, being reported in 2014 across Syria.

One can only wish Envoy De Mistura and like-minded proponents of the immediate establishment of a “freeze zone” in Aleppo, to be replicated across Syria as strongly favored by army commanders with whom this observer recently discussed the subject, the very best of luck in the New Year.

Freezing hostilities in Aleppo could possibly achieve the same for Syria. It’s worth a try.

Dr. Franklin Lamb is Director, Americans Concerned for Middle East Peace, Beirut-Washington DC, Board Member of The Sabra Shatila Foundation, and a volunteer with the Palestine Civil Rights Campaign, Lebanon. He is the author of and is doing research in Lebanon for his next book. He can be reached at

Dr. Franklin Lamb is a regular columnist for Veracity Voice

Will Falling Oil Prices Crash The Markets?

December 14, 2014 by Administrator · Leave a Comment

Shale Leads The Way…

Crude oil prices dipped lower on Wednesday pushing down yields on US Treasuries and sending stocks down sharply. The 30-year UST slipped to a Depression era 2.83 percent while all three major US indices plunged into the red. The Dow Jones Industrial Average (DJIA) led the retreat losing a hefty 268 points before the session ended. The proximate cause of Wednesday’s bloodbath was news that OPEC had reduced its estimate of how much oil it would need to produce in 2015 to meet weakening global demand. According to USA Today:

“OPEC lowered its projection for 2015 production to 28.9 million barrels a day, or about 300,000 fewer than previously forecast, and a 12-year low…. That’s about 1.15 million barrels a day less than the cartel pumped last month, when OPEC left unchanged its 30 million barrel daily production quota…

The steep decline in crude price raises fears that small exploration and production companies could go out of business if the prices fall too low. And that, in turn, could cause turmoil among those who are lending to them: Junk-bond purchasers and smaller banks.” (USA Today)

Lower oil prices do not necessarily boost consumption or strengthen growth. Quite the contrary. Weaker demand is a sign that deflationary pressures are building and stagnation is becoming more entrenched. Also, the 42 percent price-drop in benchmark U.S. crude since its peak in June, is pushing highly-leveraged energy companies closer to the brink. If these companies cannot roll over their debts, (due to the lower prices) then many will default which will negatively impact the broader market. Here’s a brief summary from analyst Wolf Richter:

“The price of oil has plunged …and junk bonds in the US energy sector are getting hammered, after a phenomenal boom that peaked this year. Energy companies sold $50 billion in junk bonds through October, 14% of all junk bonds issued! But junk-rated energy companies trying to raise new money to service old debt or to fund costly fracking or off-shore drilling operations are suddenly hitting resistance.

And the erstwhile booming leveraged loans, the ugly sisters of junk bonds, are causing the Fed to have conniptions. Even Fed Chair Yellen singled them out because they involve banks and represent risks to the financial system. Regulators are investigating them and are trying to curtail them through “macroprudential” means, such as cracking down on banks, rather than through monetary means, such as raising rates. And what the Fed has been worrying about is already happening in the energy sector: leveraged loans are getting mauled. And it’s just the beginning…

“If oil can stabilize, the scope for contagion is limited,” Edward Marrinan, macro credit strategist at RBS Securities, told Bloomberg. “But if we see a further fall in prices, there will have to be a reaction in the broader market as problems will spill out and more segments of the high-yield space will feel the pain.”…Unless a miracle happens that will goose the price of oil pronto, there will be defaults, and they will reverberate beyond the oil patch.” (Oil and Gas Bloodbath Spreads to Junk Bonds, Leveraged Loans. Defaults Next, Wolf Ricter, Wolf Street)

The Fed’s low rates and QE pushed down yields on corporate debt as investors gorged on junk thinking the Fed “had their back”. That made it easier for fly-by-night energy companies to borrow tons of money at historic low rates even though their business model might have been pretty shaky. Now that oil is cratering, investors are getting skittish which has pushed up rates making it harder for companies to refinance their debtload. That means a number of these companies going to go bust, which will create losses for the investors and pension funds that bought their debt in the form of financially-engineered products. The question is, is there enough of this financially-engineered gunk piled up on bank balance sheets to start the dominoes tumbling through the system like they did in 2008?

That question was partially answered on Wednesday following OPEC’s dismal forecast which roiled stocks and send yields on risk-free US Treasuries into a nosedive. Investors ditched their stocks in a mad dash for the exits thinking that the worst is yet to come. USTs provide a haven for nervous investors looking for a safe place to hunker down while the storm passes.

Economist Jack Rasmus has an excellent piece at Counterpunch which explains why investors are so jittery. Here’s a clip from his article titled “The Economic Consequences of Global Oil Deflation”:

“Oil deflation may lead to widespread bankruptcies and defaults for various non-financial companies, which will in turn precipitate financial instability events in banks tied to those companies. The collapse of financial assets associated with oil could also have a further ‘chain effect’ on other forms of financial assets, thus spreading the financial instability to other credit markets.” (The Economic Consequences of Global Oil Deflation, Jack Rasmus, CounterPunch)

Falling oil prices typically drag other commodities prices down with them. This, in turn, hurts emerging markets that depend heavily on the sale of raw materials. Already these fragile economies are showing signs of stress from rising inflation and capital flight. In a country like Japan, however, one might think the effect would be positive since the lower yen has made imported oil more expensive. But that’s not the case. Falling oil prices increase deflationary pressures forcing the Bank of Japan to implement more extreme measures to reverse the trend and try to stimulate growth. What new and destabilizing policy will Japan’s Central Bank employ in its effort to dig its way out of recession? And the same question can be asked of Europe too, which has already endured three bouts of recession in the last five years. Here’s Rasmus again on oil deflation and global financial instability:

“Oil is not only a physical commodity bought, sold and traded on global markets; it has also become an important financial asset since the USA and the world began liberalized trading of oil commodity futures…

Just as declines in oil spills over to declines of other physical commodities…price deflation can also ‘spill over’ to other financial assets, causing their decline as well, in a ‘chain like’ effect.

That chain like effect is not dissimilar to what happened with the housing crash in 2006-08. At that time the deep contraction in the global housing sector ( a physical asset) not only ‘spilled over’ to other sectors of the real economy, but to mortgage bonds…and derivatives based upon those bonds, also crashed. The effect was to ‘spill over’ to other forms of financial assets that set off a chain reaction of financial asset deflation.

The same ‘financial asset chain effect’ could arise if oil prices continued to decline below USD$60 a barrel. That would represent a nearly 50 percent deflation in oil prices that could potentially set in motion a more generalized global financial instability event, possibly associated with a collapse of the corporate junk bond market in the USA that has fueled much of USA shale production.” (CounterPunch)

This is precisely the scenario we think will unfold in the months ahead. What Rasmus is talking about is “contagion”, the lethal spill-over from one asset class to another due to deteriorating conditions in the financial markets and too much leverage. When debts can no longer be serviced, defaults follow sucking liquidity from the system which leads to a sudden (and excruciating) repricing event. Rasmus believes that a sharp cutback in Shale gas and oil production could ignite a crash in junk bonds that will pave the way for more bank closures. Here’s what he says:

“The shake out in Shale that is coming will not occur smoothly. It will mean widespread business defaults in the sector. And since much of the drilling has been financed with risky high yield corporate ‘junk’ bonds, the shale shake out could translate into a financial crash of the US corporate junk bond market, which is now very over-extended, leading to regional bank busts in turn.” (CP)

The financial markets are a big bubble just waiting to burst. If Shale doesn’t do the trick, then something else will. It’s just a matter of time.

Rasmus also believes that the current oil-glut is politically motivated. Washington’s powerbrokers persuaded the Saudis to flood the market with petroleum to push down prices and crush oil-dependent Moscow. The US wants a weak and divided Russia that will comply with US plans to increase its military bases in Central Asia and allow NATO to be deployed to its western borders. Here’s Rasmus again:

“Saudi Arabia and its neocon friends in the USA are targeting both Iran and Russia with their new policy of driving down the price of oil. The impact of oil deflation is already severely affecting the Russian and Iranian economies. In other words, this policy of promoting global oil price deflation finds favor with significant political interests in the USA, who want to generate a deeper disruption of Russian and Iranian economies for reasons of global political objectives. It will not be the first time that oil is used as a global political weapon, nor the last.” (CP)

Washington’s strategy is seriously risky. There’s a good chance the plan could backfire and send stocks into freefall wiping out trillions in a flash. Then all the Fed’s work would amount to nothing.

Karma’s a bitch.

Mike Whitney is a regular columnist for Veracity Voice

Mike Whitney lives in Washington state. He can be reached at:

Ultimate Schadenfreude: Democrat Is Twice Bitten, Not Shy

November 21, 2014 by Administrator · Leave a Comment

There’s stupid. There’s really stupid. There’s really, really stupid.

Then there’s Democrat stupid.

A prime example is a Friday Wall Street Journal article titled “This Democrat Is Giving Up on ObamaCare.” It’s penned by one Burke Beu, someone I describe as “ethnically Democrat,” as he says “I grew up in a Democratic family. I have been a registered Democrat since age 18.” He also tells us, “[I was] a Democratic candidate for statewide office in Colorado and a party precinct captain in that caucus state. I’ve volunteered for numerous Democratic candidates and contributed to party causes and campaigns. The 2014 election results were extremely disappointing for me….”

And, of course, Mr. Beu has soured on ObamaCare. In fact, he wants it repealed. All good so far. Except that he doesn’t have any explicitly harsh words for Obama, hasn’t given up on his party, wants a single-payer system and seems to believe Hillary Clinton is the solution in 2016. (Note: In fairness, Clinton is different from Obama — she has two X chromosomes.) But here are the money lines:

I voted for Barack Obama in 2008, then lost my job in the Great Recession. I was lucky; my brother lost his job and his house. I survived on part-time jobs while paying out-of-pocket for my health insurance.

I voted for President Obama again in 2012, then received a cancellation notice for my health insurance. This was due to ObamaCare, the so-called Affordable Care Act. However, I couldn’t afford anything else.

Does this guy wear a “Kick me” sign?

Nah.

He wears a “Kick me harder” sign.

There’s a saying, “Fool me once, shame on you. Fool me twice, shame on me.” What do you say about a guy whose life consists of being fooled?

Beu believes Medicare should be “a model for health-care reform” and says “We Democrats need to get over ourselves, start anew on a national health-care policy, and return to our progressive principles.”

Actually, sir, you need to get over your party.

First, “progressive principles” is an oxymoron; liberals don’t have principles, but provisional positions. This is because they’re governed by emotion, which changes with the wind. As G.K. Chesterton put it, “Progress is a comparative of which we have not settled the superlative.” No, I won’t explain that, Mr. Beu. You figure it out.

Beu also mentions the “stupidity of the American voter” remark by ObamaCare designer Jonathan Gruber, taking umbrage and saying “Such comments…are insults to every citizen regardless of party.” So Goober is offended by Gruber.

And Beu is one of those very “useful” people. He doesn’t get that elitist snobbery and superciliousness define the left. Just think of the revelations about socialist French president François Hollande, who is “a cold, cynical cheat and a Socialist who ‘doesn’t like the poor,’” writes National Post about insights provided by the leftist’s ex-girlfriend Valérie Trierweiler. “He presents himself as the man who doesn’t like the rich. In reality, the president doesn’t like the poor” and in private calls them “the toothless ones,” reports Trierweiler. Oh, too anecdotal? “Hell hath no fury like that of a woman scorned”? Then read the 2008 piece “Don’t listen to the liberals — Right-wingers really are nicer people, latest research shows.” It relates what some of us without “Kick me” signs figured out for ourselves long ago.

Beu also says, when pointing out that Democrats need to exhibit humility and admit error on ObamaCare, “We resent Republicans who act morally superior and pretend to have a monopoly on patriotism, but….”

It’s not pretense, Bucko. As this Pew poll from this summer shows, while 72 percent of “steadfast conservatives” and 81 percent of “business conservatives” “often feel proud to be American,” only 40 percent of “solid liberals” do. That, Mr. Beu, is by liberals’ own admission. (Pew also has a category in the poll called “Faith and Family Left.” I’ve never heard of such a thing — unless it refers to faith in government and the family of the person the liberal is cheating on his spouse with.)

Note also that when liberals and conservatives don’t feel proud to be American, it’s for very different reasons. Liberals don’t like what America was, was meant to be, and what they often imagine it to be (“We’re so Puritan!”); conservatives don’t like the cesspool the liberals are turning it into.

I know schadenfreude isn’t a feeling reflective of a charitable spirit, but the best I can say about the Beus of the world is that they need tough love. Mr. Beu reminds me of a guy who’s being held by the back of the neck, is being repeatedly and violently kicked, and complains about how something needs to be done about the foot. Tend to the foot. Regulate the foot. Repeal the foot.

Mr. Beu, that foot happens to be attached to a man, a being with intellect and free will. And he is not your friend.

Selwyn Duke is a writer, columnist and public speaker whose work has been published widely online and in print, on both the local and national levels. He has been featured on the Rush Limbaugh Show and has been a regular guest on the award-winning Michael Savage Show. His work has appeared in Pat Buchanan’s magazine The American Conservative and he writes regularly for The New American and Christian Music Perspective.

He can be reached at:

Selwyn Duke is a regular columnist for Veracity Voice

The American Dream, Gone

November 8, 2014 by Administrator · Leave a Comment

15 Reasons Why Americans Think We’re Still in a Recession…

1: Wage Stagnation: Why America’s Workers Need Faster Wage Growth—And What We Can Do About It, Elise Gould, EPI

Economic Policy Institute:

“The hourly compensation of a typical worker grew in tandem with productivity from 1948-1973. …. After 1973, productivity grew strongly, especially after 1995, while the typical worker’s compensation was relatively stagnant. This divergence of pay and productivity has meant that many workers were not benefitting from productivity growth—the economy could afford higher pay but it was not providing it.

Between 1979 and 2013, productivity grew 64.9 percent, while hourly compensation of production and nonsupervisory workers, who comprise over 80 percent of the private-sector workforce, grew just 8.0 percent. Productivity thus grew eight times faster than typical worker compensation…” (EPI)

(Note: Flatlining wages are the Number 1 reason that the majority of Americans still think we’re in a recession.)

2: Most people still haven’t recouped what they lost in the crash: Typical Household Wealth Has Plunged 36% Since 2003, Zero Hedge

Zero Hedge:

“According to a new study by the Russell Sage Foundation, the inflation-adjusted net worth for the typical household was $87,992 in 2003. Ten years later, it was only $56,335, or a 36% decline… Welcome to America’s Lost Decade.

Simply put, the NY Times notes, it’s not merely an issue of the rich getting richer. The typical American household has been getting poorer, too.

The reasons for these declines are complex and controversial, but one point seems clear: When only a few people are winning and more than half the population is losing, surely something is amiss. (chart)”

3: Most working people are still living hand-to-mouth: 76% of Americans are living paycheck-to-paycheck, CNN Money

CNN:

“Roughly three-quarters of Americans are living paycheck-to-paycheck, with little to no emergency savings, according to a survey released by Bankrate.com Monday.

Fewer than one in four Americans have enough money in their savings account to cover at least six months of expenses, enough to help cushion the blow of a job loss, medical emergency or some other unexpected event, according to the survey of 1,000 adults. Meanwhile, 50% of those surveyed have less than a three-month cushion and 27% had no savings at all…

Last week, online lender CashNetUSA said 22% of the 1,000 people it recently surveyed had less than $100 in savings to cover an emergency, while 46% had less than $800. After paying debts and taking care of housing, car and child care-related expenses, the respondents said there just isn’t enough money left over for saving more.”

4: Millennials are Drowning in Red Ink: Biggest economic threat? Student loan debt, USA Today

USA Today:

“Total student loan debt has grown more than 150% since 2005… We have more than $1.2 trillion of student loan debt…

And while 6.7 million borrowers in repayment mode are delinquent, the sad fact is that many lenders aren’t exactly incentivized to work with borrowers. Unlike all other forms of debt, student loans can’t be discharged in bankruptcy. Moreover, lenders can garnish wages and even Social Security benefits to get repaid…In 2005 student loans accounted for less than 13% of the total debt load for adults age 20-29. Today, student loans account for nearly 37% of that group’s outstanding debt. Student loan debt’s slice of the total debt pie for the age group nearly tripled! The average loan balance for that age group is now more than $25,500, up from $15,900 in 2005.”

5: Downward mobility is the new reality: Middle-Class Death Watch: As Poverty Spreads, 28 Percent of Americans Fall Out of Middle Class, Truthout

Truthout:

“The promise of the American dream has given many hope that they themselves could one day rise up the economic ladder. But according to a study released those already in financially-stable circumstances should fear falling down a few rungs too. The study… found that nearly a third of Americans who were part of the middle class as teenagers in the 1970s have fallen out of it as adults… its findings suggest the relative ease with which people in the U.S. can end up in low-income, low-opportunity lifestyles — even if they started out with a number of advantages. Though the American middle class has been repeatedly invoked as a key factor in any economic turnaround, numerous reports have suggested that the middle class enjoys less existential security than it did a generation ago, thanks to stagnating incomes and the decline of the industrial sector.”

6: People are more vulnerable than ever: “More Than Half Of All Americans Can’t Come Up With $400 In Emergency Cash… Unless They Borrow“, Personal Liberty

“According to a Federal Reserve report on American households’ “economic well-being” in 2013, fewer than half of all Americans said they’d be able to come up with four Benjamins on short notice to deal with an unexpected expense…

Under a section titled “Savings,” the report notes that “[s]avings are depleted for many households after the recession,” and lists the following findings:*Among those who had savings prior to 2008, 57 percent reported using up some or all of their savings in the Great Recession and its aftermath.

*39 percent of respondents reported having a rainy day fund adequate to cover three months of expenses.

*Only 48 percent of respondents said that they would completely cover a hypothetical emergency expense costing $400 without selling something or borrowing money.

7: Working people are getting poorer: The Typical Household, Now Worth a Third, New York Times

NYT:

“The inflation-adjusted net worth for the typical household was $87,992 in 2003. Ten years later, it was only $56,335, or a 36 percent decline, according to a study financed by the Russell Sage Foundation.

Those are the figures for a household at the median point in the wealth distribution — the level at which there are an equal number of households whose worth is higher and lower. But during the same period, the net worth of wealthy households increased substantially….“The housing bubble basically hid a trend of declining financial wealth at the median that began in 2001,” said Fabian T. Pfeffer, the University of Michigan professor who is lead author of the Russell Sage Foundation study.

The reasons for these declines are complex and controversial, but one point seems clear: When only a few people are winning and more than half the population is losing, surely something is amiss.”

8: Most people can’t even afford to get their teeth fixed: 7 things the middle class can’t afford anymore, USA Today

USA Today:

“A vacation is an extra expense that many middle-earners cannot afford without sacrificing something else. A Statista survey found that this year 54% of people gave up purchasing big ticket items like TVs or electronics so they can go on a vacation. Others made sacrifices like reducing or eliminating their trips to the movies (47%), reducing or eliminating trips out to restaurants (43%), or avoiding purchasing small ticket items like new clothing (43%).

2–New vehicles…

3–To pay off debt…

4–Emergency savings…

5–Retirement savings…

6–Medical care…

7–Dental work…According to the U.S. Department of Health and Human Services, “the U.S. spends about $64 billion each year on oral health care — just 4% is paid by Government programs.” About 108 million people in the U.S. have no dental coverage and even those who are covered may have trouble getting the care they need, the department reports.”

9: The good, high-paying jobs have vanished: Recovery Has Created Far More Low-Wage Jobs Than Better-Paid Ones, New York Times

NYT:

“The deep recession wiped out primarily high-wage and middle-wage jobs. Yet the strongest employment growth during the sluggish recovery has been in low-wage work, at places like strip malls and fast-food restaurants.

In essence, the poor economy has replaced good jobs with bad ones. That is the conclusion of anew report from the National Employment Law Project, a research and advocacy group, analyzing employment trends four years into the recovery.

“Fast food is driving the bulk of the job growth at the low end — the job gains there are absolutely phenomenal,” said Michael Evangelist, the report’s author. “If this is the reality — if these jobs are here to stay and are going to be making up a considerable part of the economy — the question is, how do we make them better?”

10: More workers are throwing in the towel: Labor Participation Rate Drops To 36 Year Low; Record 92.6 Million Americans Not In Labor Force, Zero Hedge

Zero Hedge:

“For those curious why the US unemployment rate just slid once more to a meager 5.9%, the lowest print since the summer of 2008, the answer is the same one we have shown every month since 2010: the collapse in the labor force participation rate, which in September slid from an already three decade low 62.8% to 62.7% – the lowest in over 36 years, matching the February 1978 lows. And while according to the Household Survey, 232,000 people found jobs, what is more disturbing is that the people not in the labor force, rose to a new record high, increasing by 315,000 to 92.6 million!

Bottom line: Unemployment has gone down because more people aren’t working and have fallen off the radar.”

11: Nearly twice as many people still rely on Food Stamps than before the recession: Food-stamp use is falling from its peak, Marketwatch

Marketwatch:

“Food-stamp use is finally moving away from the peak. At 46.1 million people, total food-stamp usage is down about 4% from its high in December 2012 of 47.8 million. Only eight states in March (the latest data available) were up from the same month of 2013.

It’s still not great news, however, considering there were 26.3 million people receiving food stamps in 2007…”

12: The ocean of red ink continues to grow: American Household Credit Card Debt Statistics: 2014, Nerd Wallet Finance

Nerd Wallet Finance:

U.S. household consumer debt profile:

*Average credit card debt: $15,607

*Average mortgage debt: $153,500

*Average student loan debt: $32,656

In total, American consumers owe:

*$11.63 trillion in debt

*An increase of 3.8% from last year

*$880.5 billion in credit card debt

*$8.07 trillion in mortgages

*$1,120.3 billion in student loans

*An increase of 11.5% from last year

13: No Recovery for working people: The collapse of household income in the US, World Socialist Web Site

WSWS:

“The US Federal Reserve’s latest Survey of Consumer Finances, released last Thursday, documents a devastating decline in economic conditions for a large majority of the population during the so-called economic recovery.

The report reveals that between 2007 and 2013, the income of a typical US household fell 12 percent. The median American household now earns $6,400 less per year than it did in 2007.

Source: Federal Reserve Survey of Consumer Finances

Much of the decline occurred during the “recovery” presided over by the Obama administration. In the three years between 2010 and 2013, the annual income of a typical household fell by an additional 5 percent.

The report also shows that wealth has become even more concentrated in the topmost economic layers. The wealth share of the top 3 percent climbed from 44.8 percent in 1989 to 54.4 percent in 2013. The share of wealth held by the bottom 90 percent fell from 33.2 percent in 1989 to 24.7 percent in 2013.”

14: Most people will work until they die: The Greatest Retirement Crisis In American History, Forbes

Forbes:

“We are on the precipice of the greatest retirement crisis in the history of the world. In the decades to come, we will witness millions of elderly Americans, the Baby Boomers and others, slipping into poverty.

Too frail to work, too poor to retire will become the “new normal” for many elderly Americans.

That dire prediction… is already coming true. Our national demographics, coupled with indisputable glaringly insufficient retirement savings and human physiology, suggest that a catastrophic outcome for at least a significant percentage of our elderly population is inevitable. With the average 401(k) balance for 65 year olds estimated at $25,000 by independent experts …the decades many elders will spend in forced or elected “retirement” will be grim…

The signs of the coming retirement crisis are all around you. Who’s bagging your groceries: a young high school kid or an older “retiree” who had to go back to work to supplement his income or qualify for health insurance?”

15: Americans are more pessimistic about the future, Polling Report

According to a CNN/ORC Poll May 29-June 1, 2014:

“Do you agree or disagree? The American dream has become impossible for most people to achieve.”

Agree: 59%

Disagree: 40%

Unsure: 1%

According to a NBC News/Wall Street Journal Poll conducted by the polling organizations of Peter Hart (D) and Bill McInturff (R). April 23-27, 2014: